UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2017

Commission file No. 1-4422

ROLLINS, INC.

(Exact name of registrant as specified in its charter)

|

| | |

Delaware | | 51-0068479 |

(State or other jurisdiction of | | (I.R.S. Employer Identification No.) |

incorporation or organization) | | |

| | |

2170 Piedmont Road, N.E., Atlanta, Georgia | | 30324 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (404) 888-2000

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

| | Name of each |

Title of each class | | Exchange on which registered |

Common Stock, $1 Par Value | | The New York Stock Exchange |

Securities registered pursuant to section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | | | | | |

| Large accelerated filer | ý | | Accelerated filer | o

| |

| Non-accelerated filer | o | | Smaller reporting company | o | (Do not check if a smaller reporting company)

|

| Emerging growth company | | | | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards pursuant to Section 13(a) of the Exchange Act. o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

The aggregate market value of Rollins, Inc. Common Stock held by non-affiliates on June 30, 2017 was $3,875,558,068 based on the reported last sale price of common stock on June 30, 2017, which is the last business day of the registrant’s most recently completed second fiscal quarter.

Rollins, Inc. had 218,209,925 shares of Common Stock outstanding as of January 31, 2018.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for the 2018 Annual Meeting of Stockholders of Rollins, Inc. are incorporated by reference into Part III, Items 10-14.

|

| | | |

Rollins, Inc. |

Form 10-K |

For the Year Ended December 31, 2017 |

Table of Contents |

| | | Page |

Part I | | | |

Item 1. | | | |

Item 1.A. | | | |

Item 1.B. | | | |

Item 2. | | | |

Item 3. | | | |

Item 4. | | | |

Item 4.A. | | | |

| | | |

Part II | | | |

Item 5. | | | |

Item 6. | | | |

Item 7. | | | |

Item 7.A. | | | |

Item 8. | | | |

Item 9. | | | |

Item 9.A. | | | |

Item 9.B. | | | |

Part III | | | |

Item 10. | | | |

Item 11. | | | |

Item 12. | | | |

Item 13. | | | |

Item 14. | | | |

| | | |

Part IV | | | |

Item 15. | | | |

| | | |

| | | |

| | | |

PART I

Item 1. Business

General

Rollins, Inc. (the “Company”) was originally incorporated in 1948 under the laws of the state of Delaware as Rollins Broadcasting, Inc.

The Company is an international service company with headquarters located in Atlanta, Georgia, providing pest and termite control services through its wholly-owned subsidiaries to both residential and commercial customers in North America, Australia, and Europe with international franchises in Central America, the Caribbean, the Middle East, Asia, the Mediterranean, Europe, Africa, Canada, Australia, and Mexico. Services are performed through a contract that specifies the pricing arrangement with the customer.

For a listing of the Company's Subsidiaries, see Note 1 - Summary of Significant Accounting Policies of Notes to the Financial Statements (Part II, Item 8, of this Form 10-k).

The Company has only one reportable segment, its pest and termite control business. Revenue, operating profit and identifiable assets for this segment, which includes the United States, Canada, Australia, Central America, the Caribbean, the Middle East, Asia, the Mediterranean, Europe, Africa, and Mexico are included in Item 8 of this document, “Financial Statements and Supplementary Data” on pages 28 and 29. The Company’s results of operations and its financial condition are not reliant upon any single customer or a few customers or the Company’s foreign operations.

Common Stock Repurchase Program

All share and per share data presented have been adjusted to account for the three-for-two stock split effective March 10, 2015. At the July 24, 2012 Board of Directors’ meeting, the Board authorized the purchase of 7.5 million shares of the Company’s common stock. During the year ended December 31, 2017, the Company did not repurchase shares on the open market compared to 0.8 million shares at a weighted average price of $27.19 in 2016, respectively. In total, there are 5.1 million additional shares authorized to be repurchased under prior Board approval. The repurchase program does not have an expiration date.

Backlog

Backlog services and orders are usually provided within the month following the month of order receipt, except in the area of prepaid pest control and bait monitoring services, which are usually provided within twelve months of order receipt. The Company does not have a material portion of its business that may be subject to renegotiation of profits or termination of contracts at the election of a governmental entity.

|

| | | | | | | | | | | |

December 31, | 2017 | | 2016 | | 2015 |

Backlog | $ | 4,875 |

| | $ | 5,303 |

| | $ | 4,352 |

|

Franchising Programs

Orkin Franchises

The Company continues to expand its growth through Orkin’s franchise program. This program is primarily used in smaller markets where it is currently not economically feasible to locate a conventional Orkin branch. Domestic franchisees are subject to a contractual buyback provision at Orkin’s option with a pre-determined purchase price using a formula applied to revenues of the franchise. International franchise agreements also contain an optional buyback provision; however, the franchisee has the prior right of renewal of agreement. The Company through its wholly-owned Orkin subsidiary began its Orkin franchise program in the U.S. in 1994, and established its first international franchise in 2000 and since has expanded to Central America, South America, the Caribbean, the Middle East, Asia, the Mediterranean, Europe, Africa, and Mexico.

|

| | | | | | | | |

| At December 31, |

Orkin Franchises | 2017 | | 2016 | | 2015 |

Domestic Franchises | 47 |

| | 50 |

| | 51 |

|

International Franchises | 81 |

| | 70 |

| | 48 |

|

Total Franchises | 128 |

| | 120 |

| | 99 |

|

Critter Control Franchises

The Company expands its animal control growth through Critter Control’s franchise program. The Company has purchased several Critter Control locations from its franchise owners while renaming and converting several Trutech locations to Critter Control. The majority of Critter Control’s locations are franchised. Critter Control has franchises in the United States and two Canada as of December 31, 2017 and 2016 respectively.

|

| | | | | | | |

| At December 31, |

Franchises | 2017 | 2016 | | 2015 |

Critter Control Franchises | 89 |

| 94 |

| | 108 |

|

Rollins Australia Franchises

The Company has Australian franchises through Rollins Australia’s wholly-owned subsidiary, Murray Pest Control and Scientific Pest Management. The Company purchased Murray Pest Control and Scientific Pest Management in 2016.

|

| | | | | |

| At December 31, |

Rollins Australia Franchises | 2017 | | 2016 |

Murray Pest Control franchises | 8 |

| | 4 |

|

Scientific Pest Management franchises | 3 |

| | 3 |

|

Total Franchises | 11 |

| | 7 |

|

Seasonality

The business of the Company is affected by the seasonal nature of the Company’s pest and termite control services. The increase in pest presence and activity, as well as the metamorphosis of termites in the spring and summer (the occurrence of which is determined by the timing of the change in seasons), has historically resulted in an increase in the revenue of the Company’s pest and termite control operations during such periods as evidenced by the following chart.

|

| | | | | | | | | | | |

| Total Net Revenues |

(in thousands) | 2017 | | 2016 | | 2015 |

First Quarter | $ | 375,247 |

| | $ | 352,736 |

| | $ | 330,909 |

|

Second Quarter | 433,555 |

| | 411,133 |

| | 392,150 |

|

Third Quarter | 450,442 |

| | 423,994 |

| | 399,746 |

|

Fourth Quarter | 414,713 |

| | 385,614 |

| | 362,500 |

|

Years ended December 31, | $ | 1,673,957 |

| | $ | 1,573,477 |

| | $ | 1,485,305 |

|

Inventories

The Company has relationships with a national pest control product distributor and other vendors for pest and termite control treatment products. The Company maintains a sufficient level of chemicals, materials and other supplies to fulfill its immediate servicing needs and to alleviate any potential short-term shortage in availability from its national network of suppliers.

Competition

The Company believes that Rollins, through its wholly-owned subsidiaries Orkin, Orkin Canada, HomeTeam Pest Defense, Western Pest Services, The Industrial Fumigant Company, Crane Pest Control, Waltham Services, Trutech, Permatreat, Rollins Australia, Critter Control, Safeguard Pest Control and Northwest Exterminating competes favorably with competitors as the world’s largest pest and termite control company. The Company’s competitors include Terminix, Ecolab, Rentokil and Anticimex.

The principal methods of competition in the Company’s pest and termite control markets are quality of service, customer proximity and guarantee terms, reputation for safety, technical proficiency, and price.

Research and Development

Expenditures by the Company on research activities relating to the development of new products or services are not significant. Some of the new and improved service methods and products are researched, developed and produced by unaffiliated universities and companies. Also, a portion of these methods and products are produced to the specifications provided by the Company.

The Company maintains a close relationship with several universities for research and validation of treatment procedures and material selection.

The Company conducts tests of new products with the specific manufacturers of such products. The Company also works closely with leading scientists, educators, industry consultants and suppliers to improve service protocols and materials.

Environmental and Regulatory Considerations

The Company’s pest control business is subject to various legislative and regulatory enactments that are designed to protect the environment, public health and consumers. Compliance with these requirements has not had a material negative impact on the Company’s financial position, results of operations or liquidity.

Federal Insecticide Fungicide and Rodenticide Act (“FIFRA”)

This federal law (as amended) grants to the states the responsibility to be the primary agent in enforcement and conditions under which pest control companies operate. Each state must meet certain guidelines of the Environmental Protection Agency in regulating the following: licensing, record keeping, contracts, standards of application, training and registration of products. This allows each state to institute certain features that set their regulatory programs in keeping with special interests of the citizens’ wishes in each state. The pest control industry is impacted by these federal and state regulations.

Food Quality Protection Act of 1996 (“FQPA”)

The FQPA governs the manufacture, labeling, handling and use of pesticides and does not have a direct impact on how the Company conducts its business.

Environmental Remediation

The Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”), also known as Superfund, is the primary Federal statute regulating the cleanup of inactive hazardous substance sites and imposing liability for cleanup on the responsible parties. Responsibilities governed by this statute include the management of hazardous substances, reporting releases of hazardous substances, and establishing the necessary contracts and agreements to conduct cleanup. Customarily, the parties involved will work with the EPA and under the direction of the responsible state agency to agree and implement a plan for site remediation. Consistent with the Company’s responsibilities under these regulations, the Company undertakes environmental assessments and remediation of hazardous substances from time to time as the Company determines its responsibilities for these purposes. As these situations arise, the Company accrues management’s best estimate of future costs for these activities. Based on management’s current estimates of these costs, management does not believe these costs are material to the Company’s financial condition or operating results.

Employees

The number of persons employed by the Company as of January 31, 2018 was approximately 13,000.

|

| | | | | | | | |

December 31, | 2017 | | 2016 | | 2015 |

Employees | 13,126 |

| | 12,153 |

| | 11,268 |

|

Available Information

Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to these reports, are available free of charge on our web site at www.rollins.com as soon as reasonably practicable after those reports are electronically filed with or furnished to the Securities and Exchange Commission.

Item 1.A. Risk Factors

Our business depends on our strong brands, and failing to maintain and enhance our brands could hurt our ability to retain and expand our base of customers.

Our strong brands, Rollins, Orkin, HomeTeam Pest Defense, Western Pest Services, Northwest Exterminating, The Industrial Fumigant Company, Crane Pest Control, Waltham Services, Trutech, Permatreat, Critter Control, Allpest, Safeguard Pest Control and other strong brands have significantly contributed to the success of our business. Maintaining and enhancing our brands increases our ability to enter new markets and launch new and innovative services that better serve the needs of our customers. Our brands may be negatively impacted by a number of factors, including, among others, reputational issues and product/technical failures. Further, if our brands are significantly damaged, our business, operating results, and financial condition may be materially and adversely affected. Maintaining and enhancing our brands will depend largely on our ability to remain a service leader and continue to provide high-quality, pest control products and services that are truly useful and play a meaningful role in people’s lives.

Economic conditions may adversely affect our business

Pest and termite services represent discretionary expenditures to many of our residential customers. As consumers restrict their discretionary expenditures, we may suffer a decline in revenues from our residential service lines. Economic downturns can also adversely affect our commercial customers, including food service, hospitality and food processing industries whose business levels are particularly sensitive to adverse economies. For example, we may lose commercial customers and related revenues because of consolidation or cessation of commercial businesses or because these businesses switch to a lower cost provider.

Our inability to attract and retain skilled workers may impair growth potential and profitability.

Our ability to remain productive and profitable will depend substantially on our ability to attract and retain skilled workers. Our ability to expand our operations is in part impacted by our ability to increase our labor force. The demand for skilled employees is high, and the supply is very limited. A significant increase in the wages paid by competing employers could result in a reduction in our skilled labor force, increases in wage rates paid by us, or both. If either of these events occurred, our capacity and profitability could be diminished, and our growth potential could be impaired.

We may not be able to maintain our competitive position in the pest control industry in the future.

We operate in a highly competitive industry. Our revenues and earnings may be affected by changes in competitors’ prices, and general economic issues. We compete with other large pest control companies, as well as numerous smaller pest control companies, for a finite number of customers. We believe that the principal competitive factors in the market areas that we serve are service quality, and product availability, terms of guarantees, reputation for safety, technical proficiency and price. Although we believe that our experience and reputation for safety and quality service are excellent, we cannot assure investors that we will be able to maintain our competitive position.

Our operations could be affected by pending and ongoing litigation.

In the normal course of business, some of the Company’s subsidiaries are defendants in a number of lawsuits or arbitrations, which allege that plaintiffs have been damaged. The Company does not believe that any pending claim, proceeding or litigation, either alone or in the aggregate, will have a material adverse effect on the Company’s financial position; however, it is possible that an unfavorable outcome of some or all of the matters, however unlikely, could result in a charge that might be material to the results of an individual year.

Our operations could be affected if there is unauthorized access of personal, financial, or other data or information about our customers, employees, third parties, or of Company’s proprietary of confidential information. We could be subject to interruption of our business operations, private litigation, reputational damage and costly penalties.

Our information technology systems, as well as the information technology systems of our third party business partners and service providers, can contain personal, financial, health, or other information that is entrusted to us by our customers and employees. Our information technology systems also contain Company’s and its wholly-owned subsidiaries’ proprietary and other confidential information related to our business, such as business plans and product development initiatives. We rely on, among other things, commercially available vendors, cyber protection systems, software, tools and monitoring to provide security for processing, transmission and storage of this information and data. The systems currently used for transmission and approval of payment card

transactions, and the technology utilized in payment cards themselves, all of which can put payment card data at risk, meet standards set by the payment card industry (“PCI”). We continue to evaluate and modify our systems and protocols for data security compliance purposes, and such standards may change from time to time. Activities by third parties, advances in computer and software capabilities and encryption technology, new tools and discoveries and other events or developments may facilitate or result in a compromise or breach of our systems. Any compromises, breaches or errors in applications related to our systems or failures to comply with applicable standards could cause damage to our reputation and interruptions in our operations, including our customers’ ability to pay for our services and products by credit card or their willingness to purchase our services and products and could result in a violation of applicable laws, regulations, orders, industry standards or agreements and subject us to costs, penalties and liabilities which could have a material adverse impact on our reputation, business, financial position, results of operations and cash flows. Also, a breach of data security could expose us to customer litigation and costs related to the reporting and handling of such a breach.

Our operations may be adversely affected if we are unable to comply with regulatory and environmental laws.

Our business is significantly affected by environmental laws and other regulations relating to the pest control industry and by changes in such laws and the level of enforcement of such laws. We are unable to predict the level of enforcement of existing laws and regulations, how such laws and regulations may be interpreted by enforcement agencies or court rulings, or whether additional laws and regulations will be adopted. We believe our present operations substantially comply with applicable federal and state environmental laws and regulations. We also believe that compliance with such laws has had no material adverse effect on our operations to date. However, such environmental laws are changed frequently. We are unable to predict whether environmental laws will, in the future, materially affect our operations and financial condition. Penalties for noncompliance with these laws may include cancellation of licenses, fines, and other corrective actions, which would negatively affect our future financial results.

We may not be able to identify, complete or successfully integrate acquisitions.

Acquisitions have been and may continue to be an important element of our business strategy. We cannot assure investors that we will be able to identify and acquire acceptable acquisition candidates on terms favorable to us in the future. We cannot assure investors that we will be able to integrate successfully the operations and assets of any acquired business with our own business. Any inability on our part to integrate and manage the growth from acquired businesses could have a material adverse effect on our results of operations and financial condition.

Our operations are affected by adverse weather conditions.

Our operations are directly impacted by the weather conditions worldwide. The business of the Company is affected by the seasonal nature of the Company’s pest and termite control services. The increase in pest presence and activity, as well as the metamorphosis of termites in the spring and summer (the occurrence of which is determined by the timing of the change in seasons), has historically resulted in an increase in the revenue and income of the Company’s pest and termite control operations during such periods. The business of the Company is also affected by extreme weather such as drought which can greatly reduce the pest population for extended periods.

Our franchisees, subcontractors, and vendors could take actions that could harm our business.

Our franchisees, subcontractors, and vendors are contractually obligated to operate their businesses in accordance with the standards set forth in our agreements with them. Each franchising brand also provides training and support to franchisees. However, franchisees, subcontractors, and vendors are independent third parties that we do not control, and who own, operate and oversee the daily operations of their businesses. As a result, the ultimate success of any franchise operation rests with the franchisee. If franchisees do not successfully operate their businesses in a manner consistent with required standards, royalty payments to us will be adversely affected and our brands’ image and reputation could be harmed. This could adversely impact our business, financial position, results of operations and cash flows. Similarly, if subcontractors, vendors and franchisees do not successfully operate their businesses in a manner consistent with required laws, standards and regulations, we could be subject to claims from regulators or legal claims for the actions or omissions of such third‑party distributors, subcontractors, vendors and franchisees. In addition, our relationship with our franchisees, subcontractors, and vendors could become strained (including resulting in litigation) as we impose new standards or assert more rigorous enforcement practices of the existing required standards. These strains in our relationships or claims could have a material adverse impact on our reputation, business, financial position, results of operations and cash flows.

From time to time, we receive communications from our franchisees regarding complaints, disputes or questions about our practices and standards in relation to our franchised operations and certain economic terms of our franchise arrangements. If franchisees or groups representing franchisees were to bring legal proceedings against us, we would vigorously defend against the claims in any

such proceeding. Our reputation, business, financial position, results of operations and cash flows could be materially adversely impacted and the price of our common stock could decline.

Our brand recognition could be impacted if we are not able to adequately protect our intellectual property and other proprietary rights that are material to our business.

Our ability to compete effectively depends in part on our rights to service marks, trademarks, trade names and other intellectual property rights we own or license, particularly our registered brand names and service marks, Orkin®, Orkin Canada®, AcuridSM, Western Pest Services®, the Industrial Fumigant Company, HomeTeam Pest Defense®, TAEXX®, Critter Control®, Northwest Exterminating®, Allpest®, Murray®, Safeguard® and others. We have not sought to register or protect every one of our marks either in the United States or in every country in which they are or may be used. Furthermore, because of the differences in foreign trademark, patent and other intellectual property or proprietary rights laws, we may not receive the same protection in other countries as we would in the United States. If we are unable to protect our proprietary information and brand names, we could suffer a material adverse impact on our reputation, business, financial position, results of operations and cash flows. Litigation may be necessary to enforce our intellectual property rights and protect our proprietary information, or to defend against claims by third parties that our products, services or activities infringe their intellectual property rights.

The Company’s management has a substantial ownership interest; public stockholders may have no effective voice in the Company’s management.

The Company has elected the “Controlled Company” exemption under Section 303A of the New York Stock Exchange (“NYSE”) Listed Company Manual. The Company is a “Controlled Company” because a group that includes the Company’s Chairman of the Board, R. Randall Rollins and his brother, Gary W. Rollins, who is the Vice Chairman and Chief Executive Officer, and a director of the Company and certain companies under their control, controls in excess of fifty percent of the Company’s voting power. As a “Controlled Company,” the Company need not comply with certain NYSE rules.

Rollins, Inc.’s executive officers, directors and their affiliates hold directly or through indirect beneficial ownership, in the aggregate, approximately 56 percent of the Company’s outstanding shares of common stock. As a result, these persons will effectively control the operations of the Company, including the election of directors and approval of significant corporate transactions such as acquisitions and approval of matters requiring stockholder approval. This concentration of ownership could also have the effect of delaying or preventing a third party from acquiring control of the Company at a premium.

Our management has a substantial ownership interest, and the availability of the Company’s common stock to the investing public may be limited.

The availability of Rollins’ common stock to the investing public would be limited to those shares not held by the executive officers, directors and their affiliates, which could negatively impact Rollins’ stock trading prices and affect the ability of minority stockholders to sell their shares. Future sales by executive officers, directors and their affiliates of all or a portion of their shares could also negatively affect the trading price of our common stock.

Provisions in Rollins, Inc.’s certificate of incorporation and bylaws may inhibit a takeover of the Company.

Rollins, Inc.’s certificate of incorporation, bylaws and other documents contain provisions including advance notice requirements for stockholder proposals and staggered terms for the Board of Directors. These provisions may make a tender offer, change in control or takeover attempt that is opposed by the Company’s Board of Directors more difficult or expensive.

Item 1.B. Unresolved Staff Comments

None

Item 2. Properties.

The Company’s administrative headquarters are owned by the Company, and are located at 2170 Piedmont Road, N.E., Atlanta, Georgia 30324. The Company owns or leases over 500 branch offices and operating facilities used in its business as well as the Rollins Training Center located in Atlanta, Georgia, the Rollins Customer Service Center located in Covington, Georgia, and the Pacific Division Administration and Training Center in Riverside, California. None of the branch offices, individually considered, represents a materially important physical property of the Company. The facilities are suitable and adequate to meet the current and reasonably anticipated future needs of the Company.

Item 3. Legal Proceedings.

In the normal course of business, certain of the Company’s subsidiaries are defendants in a number of lawsuits, claims or arbitrations which allege that the subsidiaries’ services caused damage. In addition, the Company defends employment related cases and claims from time to time. We are involved in certain environmental matters primarily arising in the normal course of business. We are actively contesting each of these matters.

Management does not believe that any pending claim, proceeding or litigation, either alone or in the aggregate will have a material adverse effect on the Company’s financial position, results of operations or liquidity; however, it is possible that an unfavorable outcome of some or all of the matters, however unlikely, could result in a charge that might be material to the results of an individual quarter or year.

Item 4. Mine Safety Disclosures.

Not applicable.

Item 4.A. Executive Officers of the Registrant.

Each of the executive officers of the Company was elected by the Board of Directors to serve until the Board of Directors’ meeting immediately following the next Annual Meeting of Stockholders or until his or herearlier removal by the Board of Directors or his or her resignation. The following table lists the executive officers of the Company and their ages, offices within the Company, and the dates from which they have continually served in their present offices with the Company.

|

| | | | | | |

Name | | Age | | Office with Registrant | | Date First Elected to Present Office |

R. Randall Rollins (1) | | 86 | | Chairman of the Board of Directors | | 10/22/1991 |

Gary W. Rollins (1) (2) | | 73 | | Vice Chairman and Chief Executive Officer | | 7/24/2001 |

John Wilson (3) | | 60 | | President and Chief Operating Officer | | 1/23/2013 |

Paul E Northen (4) | | 53 | | Vice President, Chief Financial Officer and Treasurer | | 1/26/2016 |

Elizabeth Chandler (5) | | 54 | | Corporate Secretary and Chief Legal Officer | | 1/1/2018 |

| |

(1) | R. Randall Rollins and Gary W. Rollins are brothers. |

| |

(2) | Gary W. Rollins was elevated to Vice Chairman Rollins in January 2013. He was elected to the office of Chief Executive Officer in July 2001. In February 2004, he was named Chairman of Orkin, LLC. |

| |

(3) | John Wilson joined the Company in 1996 and has held various positions of increasing responsibility, serving as a technician, sales inspector, branch manager, region manager, vice president and division president. His most senior positions have included Vice President of Rollins, Inc., Southeast Division President, Atlantic Division Vice President and Central Commercial region manager. Mr. Wilson was elevated to President and Chief Operating Officer in January 2013. |

| |

(4) | Paul E. Northen joined Rollins in 2015 as CFO and Corporate Treasurer. He was promoted to Vice President of Rollins, Inc. in January 2016. He began his career with UPS in 1985 and brings a wealth of Tax, Risk Management and Audit experience as well as strong international exposure to Rollins. Prior to joining Rollins, Mr. Northen was Vice President of International Finance and Accounting-Global Business Services for UPS. He previously held the positions of CFO of UPS’ Asia Pacific Region based in Hong Kong, and as Vice President of Finance in UPS’ Pacific and Western Regions. |

| |

(5) | Elizabeth (Beth) Brannen Chandler joined Rollins in 2013 as Vice President and General Counsel. In 2016, Beth assumed responsibility for the Risk Management and Internal Audit groups. She was appointed to Corporate Secretary in January 2018. Before joining Rollins, Mrs. Chandler was vice president, general counsel and corporate secretary for Asbury Automotive. Prior to working with Asbury, Mrs. Chandler served as city attorney for the City of Atlanta; and she served as vice president, assistant general counsel and corporate secretary for Mirant Corp. |

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

The Common Stock of the Company is listed on the New York Stock Exchange and is traded on the Philadelphia, Chicago and Boston Exchanges under the symbol ROL. The high and low prices of the Company’s common stock and dividends paid for each quarter in the years ended December 31, 2017 and 2016, were as follows:

STOCK PRICES AND DIVIDENDS

Rounded to the nearest $.01

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Dividends Paid Per Share | | | | | | | | Dividends Paid Per Share |

| | Stock Price | | | | | Stock Price | |

2017 | | High | | Low | | | 2016 | | High | | Low | |

First Quarter | | $ | 37.29 |

| | $ | 32.82 |

| | $ | 0.12 |

| | First Quarter | | $ | 29.11 |

| | $ | 23.69 |

| | $ | 0.10 |

|

Second Quarter | | $ | 43.75 |

| | $ | 35.82 |

| | $ | 0.12 |

| | Second Quarter | | $ | 29.27 |

| | $ | 26.21 |

| | $ | 0.10 |

|

Third Quarter | | $ | 46.22 |

| | $ | 39.90 |

| | $ | 0.12 |

| | Third Quarter | | $ | 29.71 |

| | $ | 27.29 |

| | $ | 0.10 |

|

Fourth Quarter | | $ | 48.29 |

| | $ | 42.82 |

| | $ | 0.22 |

| | Fourth Quarter | | $ | 34.24 |

| | $ | 28.00 |

| | $ | 0.20 |

|

As of January 31, 2018, there were 2,496 holders of record of the Company’s common stock. However, a large number of our shareholders hold their shares in “street name” in brokerage accounts and, therefore, do not appear on the shareholder list maintained by our transfer agent.

On January 23, 2018 the Board of Directors approved a 21.7% increase in the Company's quarterly cash dividend per common share to $0.14 payable March 9, 2018 to stockholders of record at the close of business February 9, 2018. On October 24, 2017, the Board of Directors declared its regular $0.115 per share as well as a special year-end dividend of $0.10 per share both payable December 11, 2017 to stockholders of record at the close of business November 10, 2017. The Company expects to continue to pay cash dividends to the common stockholders, subject to the earnings and financial condition of the Company and other relevant factors.

Issuer Purchases of Equity Securities

During the years ended December 31, 2017, the Company did not repurchase shares on the open market compared to 0.8 million shares at a weighted average price of $27.19 in 2016. In total, there remain 5.1 million additional shares authorized to be repurchased under prior Board approval. The repurchase program does not have an expiration date.

|

| | | | | | | | | | | | | |

Period | | Total Number of Shares Purchased (1) | | Weighted Average Price Paid per Share | | Total Number of Shares Purchased as Part of Publicly Announced Repurchase Plans (2) | | Maximum Number of Shares that May Yet Be Purchased Under the Repurchase Plans |

October 1 to 31, 2017 | | — |

| | $ | — |

| | — |

| | 5,073,611 |

|

November 1 to 30, 2017 | | — |

| | — |

| | — |

| | 5,073,611 |

|

December 1 to 31, 2017 | | 1,167 |

| | 46.53 |

| | — |

| | 5,073,611 |

|

Total | | 1,167 |

| | $ | 46.53 |

| | — |

| | 5,073,611 |

|

| |

(1) | Includes repurchases from employees for the payment of taxes on vesting of restricted shares in the following amounts: October 2017: 0; November 2017: 0; and December 2017: 1,167. |

| |

(2) | The Company has a share repurchase plan adopted in 2012, to repurchase up to 7.5 million shares of the Company’s common stock. The plan has no expiration date. |

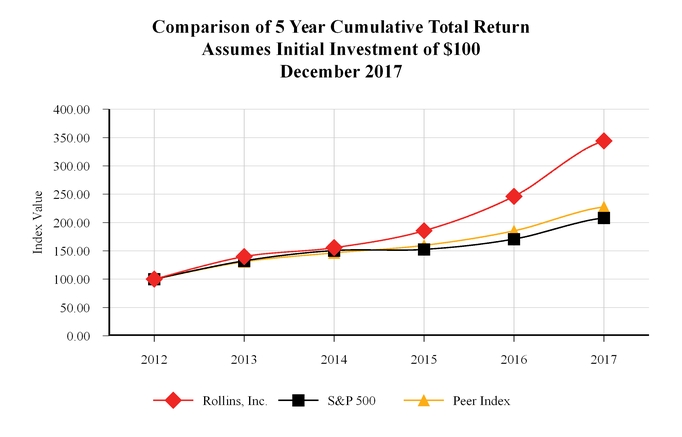

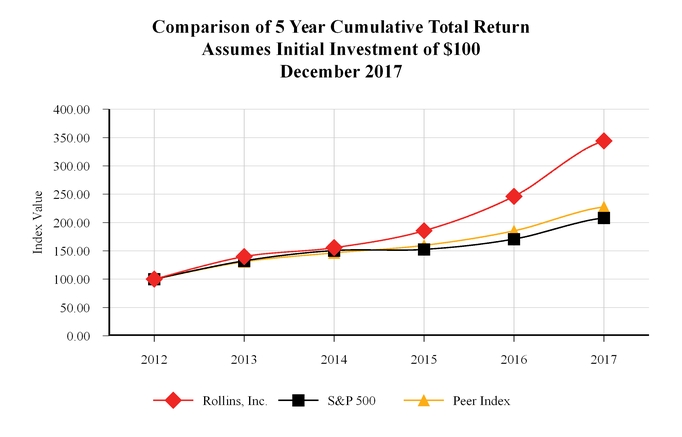

PERFORMANCE GRAPH

The following graph sets forth a five year comparison of the cumulative total stockholder return based on the performance of the stock of the Company as compared with both a broad equity market index and an industry index. The indices included in the following graph are the S&P 500 Index and the S&P 500 Commercial Services Index.

COMPARISON OF FIVE YEAR CUMULATIVE TOTAL RETURN*

|

| | | | | | | | | | | | | | | | | |

Rollins, Inc., S&P 500 Index and peer group composite index | | | | | | | | |

Cumulative Total Shareholder Return $ at Fiscal Year End | 2012 | | 2013 | | 2014 | | 2015 | | 2016 | | 2017 |

Rollins, Inc. | 100.00 |

| | 139.85 |

| | 155.55 |

| | 185.54 |

| | 246.31 |

| | 344.05 |

|

S&P 500 | 100.00 |

| | 132.39 |

| | 150.51 |

| | 152.59 |

| | 170.84 |

| | 208.14 |

|

Peer Index | 100.00 |

| | 130.77 |

| | 146.46 |

| | 159.68 |

| | 185.38 |

| | 227.58 |

|

ASSUMES INITIAL INVESTMENT OF $100

*TOTAL RETURN ASSUMES REINVESTMENT OF DIVIDENDS

NOTE: TOTAL RETURNS BASED ON MARKET CAPITALIZATION

Item 6 Selected Financial Data

The following summary financial data of Rollins highlights selected financial data and should be read in conjunction with the financial statements included elsewhere in this document.

FIVE-YEAR FINANCIAL SUMMARY

Rollins, Inc. and Subsidiaries

|

| | | | | | | | | | | | | | | | | | | |

STATEMENT OF OPERATIONS DATA: | | | | | | | | | |

| (in thousands except per share data) |

Years ended December 31, | 2017 | | 2016 | | 2015 | | 2014 | | 2013 |

Revenues | $ | 1,673,957 |

| | $ | 1,573,477 |

| | $ | 1,485,305 |

| | $ | 1,411,566 |

| | $ | 1,337,374 |

|

Income Before Income Taxes | 294,502 |

| | 260,636 |

| | 243,178 |

| | 219,484 |

| | 191,606 |

|

Net Income | 179,124 |

| | 167,369 |

| | 152,149 |

| | 137,664 |

| | 123,330 |

|

Earnings Per Share - Basic: | 0.82 |

| | 0.77 |

| | 0.70 |

| | 0.63 |

| | 0.56 |

|

Earnings Per Share - Diluted: | 0.82 |

| | 0.77 |

| | 0.70 |

| | 0.63 |

| | 0.56 |

|

Dividends paid per share | 0.56 |

| | 0.50 |

| | 0.42 |

| | 0.35 |

| | 0.30 |

|

OTHER DATA: | | | | | | | | | |

Net cash provided by operating activities | $ | 235,370 |

| | $ | 226,525 |

| | $ | 196,356 |

| | $ | 194,146 |

| | $ | 162,665 |

|

Net cash used in investing activities | (154,175 | ) | | (76,842 | ) | | (69,942 | ) | | (89,471 | ) | | (30,790 | ) |

Net cash used in financing activities | (130,263 | ) | | (136,371 | ) | | (97,216 | ) | | (106,519 | ) | | (75,653 | ) |

Depreciation | 27,381 |

| | 24,725 |

| | 19,354 |

| | 16,627 |

| | 14,415 |

|

Amortization of intangible assets | 29,199 |

| | 26,177 |

| | 25,168 |

| | 26,882 |

| | 25,156 |

|

Capital expenditures | $ | (24,680 | ) | | $ | (33,081 | ) | | $ | (39,495 | ) | | $ | (28,739 | ) | | $ | (18,632 | ) |

BALANCE SHEET DATA AT END OF YEAR: | | | | | | | | | |

Current assets | $ | 262,795 |

| | $ | 290,171 |

| | $ | 269,434 |

| | $ | 241,194 |

| | $ | 234,924 |

|

Total assets | 1,033,663 |

| | 916,538 |

| | 848,651 |

| | 808,162 |

| | 739,217 |

|

Stockholders’ equity | $ | 653,924 |

| | $ | 568,545 |

| | $ | 524,029 |

| | $ | 462,676 |

| | $ | 438,255 |

|

Number of shares outstanding at year-end | 217,992 |

| | 217,792 |

| | 218,553 |

| | 218,283 |

| | 218,797 |

|

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Presentation

This discussion should be read in conjunction with our audited financial statements and related notes included elsewhere in this document. The following discussion (as well as other discussions in this document) contains forward-looking statements. Please see “Cautionary Statement Regarding Forward-Looking Statements” for a discussion of uncertainties, risks and assumptions associated with these statements.

The Company

Rollins, Inc. (the “Company”) was originally incorporated in 1948 under the laws of the state of Delaware as Rollins Broadcasting, Inc. The Company is an international service company with headquarters located in Atlanta, Georgia, providing pest and termite control services through its wholly-owned subsidiaries to both residential and commercial customers in North America, Australia, and Europe with international franchises in Central America, South America, the Caribbean, the Middle East, Asia, the Mediterranean, Europe, Africa, and Mexico. Services are performed through a contract that specifies the treatment and the pricing arrangement with the customer.

The Company has only one reportable segment, its pest and termite control business. The Company’s results of operations and its financial condition are not reliant upon any single customer or a few customers or the Company’s foreign operations.

Overview

RESULTS OF OPERATIONS

|

| | | | | | | | | | | | | | | | | |

| | | | | | | % better/(worse) as compared to prior year |

| (in thousands) | |

Years ended December 31, | 2017 | | 2016 | | 2015 | | 2017 | | 2016 |

Revenues | $ | 1,673,957 |

| | $ | 1,573,477 |

| | $ | 1,485,305 |

| | 6.4 | % | | 5.9 | % |

Cost of services provided | 819,943 |

| | 772,348 |

| | 735,976 |

| | (6.2 | ) | | (4.9 | ) |

Depreciation and amortization | 56,580 |

| | 50,902 |

| | 44,522 |

| | (11.2 | ) | | (14.3 | ) |

Sales, general and administrative | 503,433 |

| | 490,528 |

| | 463,742 |

| | (2.6 | ) | | (5.8 | ) |

Gain on sales of assets, net | (242 | ) | | (777 | ) | | (1,953 | ) | | (68.9 | ) | | (60.2 | ) |

Interest income | (259 | ) | | (160 | ) | | (160 | ) | | 61.9 |

| | — |

|

Income before income taxes | 294,502 |

| | 260,636 |

| | 243,178 |

| | 13.0 |

| | 7.2 |

|

Provision for income taxes | 115,378 |

| | 93,267 |

| | 91,029 |

| | (23.7 | ) | | (2.5 | ) |

Net income | $ | 179,124 |

| | $ | 167,369 |

| | $ | 152,149 |

| | 7.0 | % | | 10.0 | % |

General Operating Comments

2017 marked the Company’s 20th consecutive year of improved revenues and profits. Revenues for the year rose 6.4 percent to $1.674 billion compared to $1.573 billion for the prior year. Income before income taxes increased 13.0% to $294.5 million compared to $260.6 million the prior year. Net income increased 7.0% to $179.1 million, with earnings per diluted share of $0.82 compared to $167.4 million, or $0.77 per diluted share for the prior year.

The Company’s 2017 net income was negatively affected by the 2017 Tax Cuts and Jobs Act (“TCJA”) which was signed in to law on December 22, 2017. The estimated negative impact of the enactment of the TCJA was an $11.6 million increase to tax expense, which was a direct decrease to net income. The $11.6 million increase in tax was as follows: $8.0 million from transition tax on foreign earnings, $2.9 million from the revaluation of deferred tax assets, and $0.7 million from reductions in tax benefits on stock compensation. This resulted in a $0.05 per diluted share decrease in net income for the year.

Net income excluding the effect of the TCJA increased 13.9% to $190.7 million or $0.87 per share. Net income and diluted earnings per share excluding the effect of the TCJA are non-GAAP financial measures. Management believes these measures help investors understand the effect of these on reported results.

All of the Company’s business lines experienced growth for the year, with residential pest control revenues up 6.4%, commercial pest control revenues up 5.1% and termite and ancillary services revenues up 9.7%.

During the year, the Company increased its presence around the world with the addition of 11 new Orkin international franchises. HomeTeam Pest Defense announced that they had reached one million TAEXX® installations. We acquired Northwest Exterminating based in Marietta, GA which contributed in the growth of the Company's revenues the last five months. Strategic acquisitions remain a priority for Rollins. The Company also continued to improve our routing and scheduling capabilities as we utilize our Customer Service Manager (“CSM”) BOSS and its Virtual Route Management feature. BOSS has been fully implemented in the Orkin’s U.S. operations.

Strategic acquisitions remain a priority for Rollins, and as in the past, we will continue to seek out companies that are a “fit” for us in both, the pest control and wildlife areas of our business.

Results of Operations—2017 Versus 2016

Overview

The Company’s revenues increased to $1.674 billion in 2017, a 6.4% increase compared to 2016. Gross margin increased to 51.0% for 2017 from 50.9% in 2016. Sales, general and administrative expense were 30.1% of revenues in 2017 compared to 31.2% in 2016. The Company’s depreciation and amortization margin increased 0.2 percentage points to 3.4% in 2017 compared to 3.2% in 2016. Rollins’ net income of $179.1 million in 2017 was an increase of $11.7 million or 7.0% over $167.4 million in 2016. Net profit margin improved to 10.7% in 2017 from 10.6% in 2016. Rollins continued to expand our global brand recognition with acquisitions in the United States and Canada as well as expanding our Orkin international franchise program in numerous countries around the globe. The Company is now in 53 countries and continues to seek new international opportunities.

Revenues

Revenues for the year ended December 31, 2017 were $1.674 billion, an increase of $100.5 million or 6.4% from 2016 revenues of $1.573 billion. Growth occurred across all service lines and brands with our Canadian and Australian companies being hindered by unfavorable foreign currency exchange rates. Organic growth and pricing accounted for approximately 4.5% of our increase and our acquisitions contributed the remaining revenue growth. Commercial pest control represented approximately 40% of the Company’s revenue in 2017 and grew 5.1% due to increases in sales, an emphasis on closing leads, increased bed bug revenue, and acquisitions. Commercial pest control was negatively impacted by foreign currency exchange as Orkin Canada and Rollins Australia are heavily commercial. Residential pest control, which represented approximately 42% of the Company’s revenue, increased 6.4% driven by an increase in lead closure, pricing, as well as increased TAEXX® homebuilder installations, and acquisitions. The Company’s termite business, which represented approximately 18% of the Company’s revenue, grew 9.7% in 2017 due to acquisitions, increases in drywood fumigations and ancillary service sales, (such as moisture control and insulation).

The Company implemented its traditional price increase program in June 2017. Less than 2% of the Company’s revenue increase is attributable to pricing actions. Approximately 80% of the Company’s pest control revenue was recurring in 2017 as well as 2016.

The Company’s foreign operations accounted for approximately 8% and 7% of total revenues for the years ended December 31, 2017 and 2016, respectively. The Company established new franchises in several international countries around the globe in 2017 for a total of 81 Orkin international franchises, two Canadian Critter Control franchises, and eleven Australian franchises operated by Murray Pest Control and Scientific Pest Management at December 31, 2017, compared to 70 Orkin international franchises, two Canadian Critter Control franchises and seven Australian Franchises at December 31, 2016.

International and domestic franchising revenue was less than 1% of the Company’s revenues for 2017. Orkin had 128 and 120 franchises (domestic and international) at December 31, 2017 and 2016, respectively. The Company had 89 Critter Control franchises at December 31, 2017, down 5 from 2016. Critter Control Operations, Inc., a wholly-owned subsidiary of the Company, has begun the process of purchasing Critter Control franchises. Revenue from franchises was down 2.9% in 2017 compared to 2016 as we acquire franchises from Critter Control.

Cost of Services Provided

For the twelve months ended December 31, 2017 cost of services provided increased $47.6 million or 6.2%, compared to the twelve months ended December 31, 2016. Gross margin for the year increased to 51.0% for 2017 compared to 50.9% for 2016 due to favorable service salary cost as we utilize BOSS, our CRM and operating system and VRM to improve our customer routing and scheduling to maximize efficiencies. We had lower administrative salaries as we maximize our efficiencies and lower insurance and claims as we saw reductions in our actuarial calculations on future losses and lower vehicle loss expenses. The favorable margins were partially offset by higher fleet costs as gasoline prices rose and leased vehicle costs as we replace our fleet and materials and supplies as we increase termite treatments. We experienced good cost controls across most spending categories during 2017 compared to 2016.

Depreciation and Amortization

For the twelve months ended December 31, 2017, depreciation and amortization increased $5.7 million, or 11.2% compared to the twelve months ended December 31, 2016. The dollar increase was primarily due to depreciation increasing $2.7 million or 10.7% as we continue to depreciate our CRM software BOSS, while amortization of intangible assets increased $3.0 million or 11.5% for 2017 due to the additional amortization of customer contracts of Northwest Exterminating, as well as several other acquisitions over the last year.

Sales, General and Administrative

For the twelve months ended December 31, 2017, sales, general and administrative (SG&A) expenses increased $12.9 million, or 2.6% compared to the twelve months ended December 31, 2016. SG&A decreased to 30.1% of revenues for the year ended December 31, 2017 compared to 31.2% in 2016. The Company had a one-time tax event to dissolve its subsidiary, Kinro Investment Inc. in 2016. This increased SG&A expense $9.1 million or 0.6 percentage points due to the one-time tax event that was offset as a credit in income tax expense. Administrative salaries were relatively flat to prior year as we reduced the number of temporary personnel working on the BOSS system. Personnel related costs were marginally lower as we experienced leveling of our premiums. Gains in these areas were partially offset by higher sales salaries, fleet expense, and contractor expenses for various projects as well as the aforementioned 2016 foreign tax withholding expense.

Gain on Sales of assets, Net

Gain on sales of assets, net decreased to $0.2 million for the year ended December 31, 2017 compared to $0.8 million in 2016. The Company recognized gains from the sale of owned vehicles and owned property in 2017 and 2016.

Interest Income, Net

Interest income, net for each of the years ended December 31, 2017 and 2016 was $0.3 million and $0.2 million, respectively. Interest income for each year is due to interest received on cash balances in the Company’s various cash accounts.

Taxes

The Company’s effective tax rate increased to 39.2% in 2017 compared to 35.8% in 2016, due primarily to the effects of the TCJA in 2017, a one-time tax event in 2016 and differences in state and foreign income taxes. The estimated impact of the enactment of the TCJA was an $11.6 million increase to tax expense, which was a direct decrease to net income. The $11.6 million increase in tax was as follows: ($8.0 million from transition tax on foreign earnings, $2.9 million from the revaluation of deferred tax assets, and $0.7 million from reductions in tax benefits on stock compensation). The increase due to the TCJA was partially offset by a reduction related to the implementation of ASU 2016-09 that was a $4.0 million benefit. Management believes that the Corporate tax rate in 2018 will be in the mid 20% range with a lower rate in the first quarter 2018 adjusted throughout the year to the mid 20% range for the year.

Results of Operations—2016 Versus 2015

Overview

The Company’s revenues increased to $1.573 billion in 2016, a 5.9% increase compared to 2015. Gross margin increased to 50.9% for 2016 from 50.4% in 2015. Sales, general and administrative expense remained flat at 31.2% of revenues in 2016 compared to 2015. The Company’s depreciation and amortization margin increased 0.2 percentage points to 3.2% in 2016 compared to 3.0% in 2015. Rollins’ net income of $167.4 million in 2016 was an increase of $15.2 million or 10.0% over $152.1 million in 2015. Net profit margin improved to 10.6% in 2016 from 10.2% in 2015. Rollins continued to expand our global brand recognition with acquisitions in the United States, Australia, and the United Kingdom as well as expanding our Orkin international franchise program in numerous countries around the globe. The Company is now in 47 countries and continues to seek new opportunities.

Revenues

Revenues for the year ended December 31, 2016 were $1.573 billion, an increase of $88.2 million or 5.9% from 2015 revenues of $1.485 billion. Growth occurred across all service lines and brands with our Canadian and Australian companies being hindered by unfavorable foreign currency exchange rates. Organic growth and pricing accounted for approximately 5.2% of our increase and our acquisitions contributed the remaining revenue growth. Commercial pest control represented approximately 40% of the Company’s revenue in 2016 and grew 4.4% due to increases in sales, increased bed bug revenue, an increase in commercial fumigations, and acquisitions. Commercial pest control was negatively impacted by foreign currency exchange as Orkin Canada and Rollins Australia are heavily commercial. Residential pest control which represented approximately 42% of the Company’s

revenue, increased 7.3% driven by increased leads, the improved closure and pricing as well as increased TAEXX® homebuilder installations, bed bug revenues and acquisitions. The Company’s termite business, which represented approximately 17% of the Company’s revenue, grew 6.3% in 2016 due to acquisitions, increases in drywood fumigations and ancillary service sales, (such as moisture control and insulation).

The Company implemented its traditional price increase program in June 2016. Less than 2% of the Company’s revenue increase came from pricing actions. Approximately 80% of the Company’s pest control revenue was recurring in 2016 as well as 2015.

The Company’s foreign operations accounted for approximately 7% of total revenues for each of the years ended December 31, 2016 and 2015, respectively. Foreign currency exchange translation and increased domestic revenues have reduced the percentage in both years. The Company established new franchises in several countries around the globe in 2016 for a total of 70 Orkin international franchises, two Canadian Critter Control franchises, and seven Australian franchises operated by Murray Pest Control and Scientific Pest Management at December 31, 2016, compared to 48 Orkin international franchises and two Canadian Critter Control franchises at December 31, 2015.

International and domestic franchising revenue was less than 1% of the Company’s revenues for 2016. Orkin had 120 and 99 franchises (domestic and international) at December 31, 2016 and 2015, respectively. The Company had 94 Critter Control franchises and 4 Murray Pest Control franchises at December 31, 2016, down 14 from 2015. Critter Control Operations, Inc., a wholly-owned subsidiary of the Company, has begun the process of purchasing Critter Control franchises. Revenue from franchises was up 8.4% in 2016 compared to 2015.

Cost of Services Provided

For the twelve months ended December 31, 2016 cost of services provided increased $36.4 million or 4.9%, compared to the twelve months ended December 31, 2015. Gross margin for the year increased to 50.9% for 2016 compared to 50.4% for 2015 due to favorable service salary cost as we finalized the roll-out of BOSS, our CRM and operating system, improving our routing and scheduling to maximize efficiencies, lower personnel related expenses as healthcare claims were lower than expected, and insurance and claims were lower as a percentage of revenues as we continue to focus on efficiency and safety. The favorable margins were partially offset by professional fees as we used outside sources to roll-out BOSS. We experienced good cost controls across most spending categories during 2016 compared to 2015.

Depreciation and Amortization

For the twelve months ended December 31, 2016, depreciation and amortization increased $6.4 million, or 14.3% compared to the twelve months ended December 31, 2015. The dollar increase was due primarily to depreciation increasing $5.4 million as we began to depreciate our CRM software BOSS, while amortization of intangible assets increased as we acquired 34 companies in 2016.

Sales, General and Administrative

For the twelve months ended December 31, 2016, sales, general and administrative (SG&A) expenses increased $26.8 million, or 5.8% compared to the twelve months ended December 31, 2015. SG&A remained flat at 31.2% of revenues for each of the years 2016 and 2015. The Company had a one-time tax event to dissolve its subsidiary, Kinro Investment Inc. This increased SG&A expense $9.1 million or 0.6 percentage points due to the one-time tax event that was offset as a credit in income tax expense. Sales salaries increased due to the increase in sales commissions and service contracts increased as a result of maintaining the BOSS system. The increases were offset by decreases as a percentage of revenue by administrative salaries as we continue to grow revenue with a static headcount, personnel related expense margin decreased due to lower than expected healthcare claims, and decreases in insurance claims as we continue to focus on efficiency and safety, and telephone costs as we negotiate contracts for Internet service.

Gain on Sales of assets, Net

Gain on sales of assets, net decreased to $0.8 million for the year ended December 31, 2016 compared to $2.0 million gain in 2015. The Company recognized gains from the sale of owned vehicles and owned property in 2016 and 2015. The decrease was due to the Company selling two buildings in 2015.

Interest (Income)/Expense, Net

Interest income, net for each of the years ended December 31, 2016 and 2015 was $0.2 million. Interest income for each year is due to interest received on cash balances in the Company’s various cash accounts.

Taxes

The Company’s effective tax rate decreased to 35.8% in 2016 compared to 37.4% in 2015, due primarily to a one-time tax event in 2016 and differences in state and foreign income taxes.

Liquidity and Capital Resources

Cash and Cash Flow

Cash from operating activities is the principal source of cash generation for our businesses.

The most significant source of cash in Rollins’ cash flow from operations is customer-related activities, the largest of which is collecting cash resulting from services sales. The most significant operating use of cash is to pay our suppliers, employees, tax authorities and others for a wide range of material and services.

The Company’s cash and cash equivalents at December 31, 2017, 2016, and 2015 were $107.1 million, $142.8 million, and $134.6 million, respectively.

|

| | | | | | | | | | | |

| 2017 | | 2016 | | 2015 |

Net cash provided by operating activities | $ | 235,370 |

| | $ | 226,525 |

| | $ | 196,356 |

|

Net cash used in investing activities | (154,175 | ) | | (76,842 | ) | | (69,942 | ) |

Net cash used in financing activities | (130,263 | ) | | (136,371 | ) | | (97,216 | ) |

Effect of exchange rate changes on cash | 13,333 |

| | (5,101 | ) | | (2,996 | ) |

Net increase (decrease) in cash and cash equivalents | $ | (35,735 | ) | | $ | 8,211 |

| | $ | 26,202 |

|

Cash Provided by Operating Activities

The Company’s operations generated cash of $235.4 million for the year ended December 31, 2017 primarily from net income of $179.1 million, compared with cash provided by operating activities of $226.5 million in 2016 and $196.4 million in 2015. The Company believes its current cash and cash equivalents balances, future cash flows expected to be generated from operating activities and available borrowings under its $175.0 million credit facility will be sufficient to finance its current operations and obligations, and fund expansion of the business for the foreseeable future.

The Company’s made no contributions to the Rollins, Inc. and its wholly-owned subsidiaries’ defined benefit retirement plans (the “Plans”) during the year ended December 31, 2017. The Plans were fully-funded with a prepaid balance. We contributed $3.3 million and $5.0 million during the years ended December 31, 2016 and 2015, respectively, as a result of the Plans’ funding status. The Company’s management is not expecting to make a contribution during fiscal year 2018. In the opinion of management, additional Plan contributions, if any, will not have a material effect on the Company’s financial position, results of operations or liquidity.

Cash Used in Investing Activities

The Company used $154.2 million on investing activities for the year ended December 31, 2017 compared to $76.8 million and $69.9 million during 2016 and 2015, respectively, and of that, invested approximately $24.7 million in capital expenditures during 2017 compared to $33.1 million and $39.5 million during 2016 and 2015, respectively. Capital expenditures for the year consisted primarily of property purchases, equipment replacements and technology related projects. The Company expects to invest between $25.0 million and $28.0 million in 2018 in capital expenditures. During 2017, the Company’s and its subsidiaries acquired Northwest Exterminating as well as several small companies for a total of $130.2 million compared to $46.3 million and $33.5 million in acquisitions during 2016 and 2015, respectively. The expenditures for the Company’s acquisitions were funded with cash on hand. The Company continues to seek new acquisitions.

Cash Used in Financing Activities

The Company used cash of $130.3 million on financing activities for the year ended December 31, 2017, compared to $136.4 million and $97.2 million during 2016 and 2015, respectively. A total of $122.0 million was paid in cash dividends ($0.56 per share) during the year ended December 31, 2017 including a special dividend paid in December 2017 of $0.10 per share, compared to $109.0 million in cash dividends paid ($0.50 per share) during the year ended December 31, 2016, including a special dividend paid in December 2016 of $0.10 per share and $91.8 million paid in cash dividends ($0.42 per share) during the year ended December 31, 2015, including a special dividend paid in December 2015 of $0.10 per share.

The Company did not purchase shares on the open market during the year ended December 31, 2017 while using $8.2 million to repurchase 0.8 million shares of its common stock at a weighted average price of $27.19 per share during 2016 and $0.4 million to purchase 19 thousand shares at an weighted average price of $22.42 in 2015. There remain 5.1 million shares authorized to be repurchased under prior Board approval. The Company repurchased $8.2 million, $8.4 million, and $7.0 million of common stock for the years ended December 31, 2017, 2016 and 2015, respectively, from employees for the payment of taxes on vesting restricted shares.

The Company’s $107.1 million of total cash at December 31, 2017, is primarily cash held at various banking institutions. Approximately $57.8 million is held in cash accounts at international bank institutions and the remaining $49.3 million is primarily held in Federal Deposit Insurance Corporation (“FDIC”) insured non-interest-bearing accounts at various domestic banks which at times may exceed federally insured amounts.

The Company’s international business is expanding and we intend to continue to grow the business in foreign markets in the future through reinvestment of foreign deposits and future earnings as well as acquisitions of unrelated companies. Repatriation of cash from the Company’s foreign subsidiaries is not a part of the Company’s current business plan.

The Company maintains a large cash position in the United States while having no third-party debt to service. Rollins maintains adequate liquidity and capital resources, without regard to its foreign deposits, that are directed to finance domestic operations and obligations and to fund expansion of its domestic business.

For Information regarding our Revolving Credit Agreement see Note 3 - Debt of the Notes to Financial Statements (Part II, Item 8 of this Form 10-K).

Litigation

For discussion on the Company’s legal contingencies, see note 13 to the accompanying financial statements.

Off Balance Sheet Arrangements, Contractual Obligations and Contingent Liabilities and Commitments

Other than the operating leases disclosed in the table that follows, the Company has no material off balance sheet arrangements.

The impact that the Company’s contractual obligations as of December 31, 2017 are expected to have on our liquidity and cash flow in future periods is as follows:

|

| | | | | | | | | | | | | | | | | | | |

| Payments due by period |

Contractual obligations (in thousands) | Total | | Less than 1 year | | 1 - 3 years | | 4 - 5 years | | More than 5 years |

Business combination related liabilities | $ | 29,389 |

| | $ | 18,661 |

| | $ | 10,728 |

| | $ | — |

| | $ | — |

|

Non-cancelable operating leases | 143,539 |

| | 34,112 |

| | 24,890 |

| | 38,713 |

| | 45,824 |

|

Unrecognized Tax Positions (1) | 4,084 |

| | 4,084 |

| | — |

| | — |

| | — |

|

Total (2) | $ | 177,012 |

| | $ | 56,857 |

| | $ | 35,618 |

| | $ | 38,713 |

| | $ | 45,824 |

|

| |

(1) | These amounts represent expected payments with interest for unrecognized tax benefits as of December 31, 2017. |

| |

(2) | Minimum pension funding requirements are not included as funding will not be required. |

Critical Accounting Policies

The Company views critical accounting policies to be those policies that are very important to the portrayal of our financial condition and results of operations, and that require management’s most difficult, complex or subjective judgments. The circumstances that make these judgments difficult or complex relate to the need for management to make estimates about the effect of matters that are inherently uncertain. We believe our critical accounting policies to be as follows:

Accrual for Termite Contracts—The Company maintains an accrual for termite claims representing the estimated costs of reapplications, repairs and associated labor and chemicals, settlements, awards and other costs relative to termite control services. Factors that may impact future cost include termiticide life expectancy and government regulation. It is significant that the actual number of claims has decreased in recent years due to changes in the Company’s business practices. However, it is not possible to precisely predict future significant claims. Accruals for termite contracts are included in other current liabilities and long-term accrued liabilities on the Company’s consolidated statements of financial position.

Accrued Insurance—The Company retains, up to specified limits, certain risks related to general liability, workers’ compensation and vehicle liability. The estimated costs of existing and future claims under the retained loss program are accrued based upon historical trends as incidents occur, whether reported or unreported (although actual settlement of the claims may not be made until future periods) and may be subsequently revised based on developments relating to such claims. The Company contracts with an independent third party actuary on a semi-annual basis to provide the Company an estimated liability based upon historical claims information. The actuarial study is a major consideration in establishing the reserve, along with management’s knowledge of changes in business practice and existing claims compared to current balances. Management’s judgment is inherently subjective and a number of factors are outside management’s knowledge and control. Additionally, historical information is not always an accurate indication of future events. The Company continues to be proactive in risk management to develop and maintain ongoing programs to reduce claims. Initiatives that have been implemented include pre-employment screening and an annual motor vehicle report required on all its drivers, post-offer physicals for new employees, pre-hire, random and post-accident drug testing, increased driver training and a post-injury nurse triage program for employees.

Revenue Recognition—The Company’s revenue recognition policies are designed to recognize revenues at the time services are performed. For certain revenue types, because of the timing of billing and the receipt of cash versus the timing of performing services, certain accounting estimates are utilized. Residential and commercial pest control services are primarily recurring in nature on a monthly, bi-monthly or quarterly basis, while certain types of commercial customers may receive multiple treatments within a given month. In general, pest control customers sign an initial one-year contract, and revenues are recognized at the time services are performed. For pest control customers, the Company offers a discount for those customers who prepay for a full year of services. The Company defers recognition of these advance payments and recognizes the revenue as the services are rendered. The Company classifies the discounts related to the advance payments as a reduction in revenues.

Termite baiting revenues are recognized based on the delivery of the individual units of accounting. At the inception of a new baiting services contract, upon quality control review of the installation, the Company recognizes revenue for the installation of the monitoring stations, initial directed liquid termiticide treatment and servicing of the monitoring stations. A portion of the contract amount is deferred for the undelivered monitoring element. This portion is recognized as income on a straight-line basis over the remaining contract term, which results in recognition of revenue in a pattern that approximates the timing of performing monitoring visits. The allocation of the purchase price to the two deliverables is based on the relative selling price. There are no contingencies related to the delivery of additional items or meeting other specified performance conditions. Baiting renewal revenue is deferred and recognized over the annual contract period on a straight-line basis that approximates the timing of performing the required monitoring visits.

Revenue received for conventional termite renewals is deferred and recognized on a straight-line basis over the remaining contract term; and, the cost of reinspections, reapplications and repairs and associated labor and chemicals are expensed as incurred. For outstanding claims, an estimate is made of the costs to be incurred (including legal costs) based upon current factors and historical information. The performance of reinspections tends to be close to the contract renewal date and while reapplications and repairs involve an insubstantial number of the contracts, these costs are incurred over the contract term. As the revenue is being deferred, the future cost of reinspections, reapplications and repairs and associated labor and chemicals applicable to the deferred revenue are expensed as incurred. The Company accrues for noticed claims. The costs of providing termite services upon renewal are compared to the expected revenue to be received and a provision is made for any expected losses.

All revenues are reported net of sales taxes.

Contingency Accruals—The Company is a party to legal proceedings with respect to matters in the ordinary course of business. In accordance with the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 450 “Contingencies,” Management estimates and accrues for its liability and costs associated with the litigation. Estimates and accruals are determined in consultation with outside counsel. Because it is not possible to accurately predict the ultimate result of the litigation, judgments concerning accruals for liabilities and costs associated with litigation are inherently uncertain and actual liabilities may vary from amounts estimated or accrued. However, in the opinion of management, the outcome of the litigation will not have a material adverse impact on the Company’s financial condition or results of operations. Contingency accruals are included in other current liabilities and long-term accrued liabilities on the Company’s consolidated statements of financial position.

Defined benefit pension plans — In 2005, the Company ceased all future benefit accruals under the Rollins, Inc. defined benefit plan, although the Company remains obligated to provide employees benefits earned through June 2005. The Company also includes the Waltham Services, LLC Hourly Employee Pension Plan to the Company’s financial statements. The Company accounts for these defined benefit plans in accordance with the FASB ASC Topic 715 “Compensation- Retirement Benefits”, and engages an outside actuary to calculate its obligations and costs. With the assistance of the actuary, the Company evaluates the significant assumptions used on a periodic basis including the estimated future return on plan assets, the discount rate, and other factors, and makes adjustments to these liabilities as necessary.

The Company chooses an expected rate of return on plan assets based on historical results for similar allocations among asset classes, the investments strategy, and the views of our investment adviser. Differences between the expected long-term return on plan assets and the actual return are amortized over future years. Therefore, the net deferral of past asset gains or losses ultimately affects future pension expense. The Company’s assumption for the expected return on plan assets is 7.0% which is unchanged from the prior year.