DEF 14AFALSE0000084839ROLLINS INCiso4217:USD00000848392024-01-012024-12-3100000848392023-01-012023-12-3100000848392022-01-012022-12-3100000848392021-01-012021-12-3100000848392020-01-012020-12-310000084839ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2024-01-012024-12-310000084839ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2024-01-012024-12-310000084839ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2023-01-012023-12-310000084839ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2023-01-012023-12-310000084839ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2022-01-012022-12-310000084839ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2022-01-012022-12-310000084839ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2021-01-012021-12-310000084839ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2021-01-012021-12-310000084839ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2020-01-012020-12-310000084839ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:NonPeoNeoMember2020-01-012020-12-310000084839ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2024-01-012024-12-310000084839ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2024-01-012024-12-310000084839ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2023-01-012023-12-310000084839ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2023-01-012023-12-310000084839ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2022-01-012022-12-310000084839ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2022-01-012022-12-310000084839ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2021-01-012021-12-310000084839ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2021-01-012021-12-310000084839ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2020-01-012020-12-310000084839ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2020-01-012020-12-310000084839ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2024-01-012024-12-310000084839ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2024-01-012024-12-310000084839ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2023-01-012023-12-310000084839ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2023-01-012023-12-310000084839ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2022-01-012022-12-310000084839ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2022-01-012022-12-310000084839ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2021-01-012021-12-310000084839ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2021-01-012021-12-310000084839ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2020-01-012020-12-310000084839ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2020-01-012020-12-310000084839ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2024-01-012024-12-310000084839ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2024-01-012024-12-310000084839ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2023-01-012023-12-310000084839ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310000084839ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2022-01-012022-12-310000084839ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2022-01-012022-12-310000084839ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2021-01-012021-12-310000084839ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2021-01-012021-12-310000084839ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:PeoMember2020-01-012020-12-310000084839ecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMemberecd:NonPeoNeoMember2020-01-012020-12-310000084839ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2024-01-012024-12-310000084839ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2024-01-012024-12-310000084839ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2023-01-012023-12-310000084839ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310000084839ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2022-01-012022-12-310000084839ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2022-01-012022-12-310000084839ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2021-01-012021-12-310000084839ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2021-01-012021-12-310000084839ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2020-01-012020-12-310000084839ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2020-01-012020-12-310000084839ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2024-01-012024-12-310000084839ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2024-01-012024-12-310000084839ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2023-01-012023-12-310000084839ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310000084839ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2022-01-012022-12-310000084839ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2022-01-012022-12-310000084839ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2021-01-012021-12-310000084839ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2021-01-012021-12-310000084839ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:PeoMember2020-01-012020-12-310000084839ecd:FrValAsOfPrrYrEndOfEqtyAwrdsGrntdInPrrYrsFldVstngCondsDrngCvrdYrMemberecd:NonPeoNeoMember2020-01-012020-12-310000084839ecd:AggtPnsnAdjsSvcCstMemberecd:PeoMember2024-01-012024-12-310000084839ecd:AggtPnsnAdjsSvcCstMemberecd:NonPeoNeoMember2024-01-012024-12-310000084839ecd:AggtPnsnAdjsSvcCstMemberecd:PeoMember2023-01-012023-12-310000084839ecd:AggtPnsnAdjsSvcCstMemberecd:NonPeoNeoMember2023-01-012023-12-310000084839ecd:AggtPnsnAdjsSvcCstMemberecd:PeoMember2022-01-012022-12-310000084839ecd:AggtPnsnAdjsSvcCstMemberecd:NonPeoNeoMember2022-01-012022-12-310000084839ecd:AggtPnsnAdjsSvcCstMemberecd:PeoMember2021-01-012021-12-310000084839ecd:AggtPnsnAdjsSvcCstMemberecd:NonPeoNeoMember2021-01-012021-12-310000084839ecd:AggtPnsnAdjsSvcCstMemberecd:PeoMember2020-01-012020-12-310000084839ecd:AggtPnsnAdjsSvcCstMemberecd:NonPeoNeoMember2020-01-012020-12-310000084839ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2024-01-012024-12-310000084839ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2024-01-012024-12-310000084839ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2023-01-012023-12-310000084839ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-310000084839ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2022-01-012022-12-310000084839ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2022-01-012022-12-310000084839ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2021-01-012021-12-310000084839ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2021-01-012021-12-310000084839ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:PeoMember2020-01-012020-12-310000084839ecd:DvddsOrOthrErngsPdOnEqtyAwrdsNtOthrwsRflctdInTtlCompForCvrdYrMemberecd:NonPeoNeoMember2020-01-012020-12-31000008483912024-01-012024-12-31000008483922024-01-012024-12-31000008483932024-01-012024-12-31000008483942024-01-012024-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

| | | | | |

x Filed by the Registrant | o Filed by a Party other than the Registrant |

| | | | | |

| Check the appropriate box: |

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a–6(e)(2)) |

| x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material under §240.14a–12 |

ROLLINS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other than the Registrant)

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| x | No fee required. |

| o | Fee paid previously with preliminary materials. |

| o | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11 |

ROLLINS, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

2170 Piedmont Road, NE, Atlanta, Georgia 30324

TO THE HOLDERS OF THE COMMON STOCK:

PLEASE TAKE NOTICE that the 2025 Annual Meeting of Shareholders (the “Annual Meeting”) of Rollins, Inc. a Delaware corporation (“Rollins” or the “Company”), will be held at the Company’s corporate office located at 2170 Piedmont Road, NE, Atlanta, Georgia, 30324, on Tuesday, April 22, 2025, at 12:30 P.M. for the following purposes, as more fully described in the proxy statement accompanying this notice:

1.The election of five director nominees to serve as directors of the Company until our 2026 Annual Meeting of Shareholders, or until their successors are duly elected and qualified.

2.To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2025.

3.To consider and act upon such other business as may properly come before the Annual Meeting or any adjournment of the meeting.

The Proxy Statement dated March 13, 2025 is attached.

The Board of Directors has fixed the close of business on February 28, 2025 as the record date for the determination of shareholders entitled to notice of, and to vote at, the Annual Meeting or any adjournment thereof.

As permitted by the U.S. Securities and Exchange Commission (the “SEC”) rules, the Company is making the proxy materials relating to the Annual Meeting, including this Proxy Statement and the Company’s 2024 Annual Report on Form 10-K for the fiscal year ended December 31, 2024 (the “Annual Report”), available to our shareholders electronically via the internet. On or about March 13, 2025, we mailed to our shareholders an Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be held on April 22, 2025 (the “Notice”) containing instructions on how to access this Proxy Statement and our Annual Report and vote online. If you received a Notice by mail, you will not receive a printed copy of the proxy materials in the mail unless you request a copy. The Notice instructs you on how to access and review all important information contained in the Proxy Statement and Annual Report. The Notice also instructs you on how you may submit your proxy over the internet. If you received a Notice by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials contained in the Notice.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of the Shareholders to be held on April 22, 2025: The Proxy Statement and Annual Report are available at http://www.viewproxy.com/ROL/2025.

We encourage you to take advantage of the availability of the proxy materials on the internet in order to help lower the costs of delivery and reduce the Company’s environmental impact.

| | | | | |

| BY ORDER OF THE BOARD OF DIRECTORS |

| |

| |

| Elizabeth B. Chandler |

| Secretary |

| Atlanta, Georgia | |

| March 13, 2025 | |

Whether or not you expect to attend the annual meeting, please sign, date and return the enclosed proxy card promptly. Alternatively, you may give a proxy by telephone or over the internet by following the instructions on your proxy card or Notice. If you decide to attend the meeting, you may, if you wish, revoke the proxy and vote your shares in person.

Table of Contents

Letter to Shareholders

To our Shareholders,

On behalf of the Board of Directors, we are pleased to share that we will hold our 2025 Annual Meeting of Shareholders on Tuesday, April 22nd, 2025, at 12:30 P.M.

Thanks to our teammates, we had another year of tremendous growth and solid financial results in 2024. Our operations performed well, and we had impressive growth in every business line. The strength of our brands motivated customers to select, retain and increase our services at high levels. Living up to our brand promises is the hallmark of the longevity and sustainable business model that we have built at Rollins.

Strategic Objectives

We have aligned around key strategic objectives that will help us to drive continued success for Rollins.

First and foremost, we promote a people first mindset that emphasizes the importance of prioritizing the well-being and development of the individual, as well as our collective team, in all aspects of our business. We put our customers and colleagues first, knowing that in order to provide the best customer experience, we must focus on cultivating our position as the employer of choice in our industry. Our people are a key competitive advantage, so we must invest in tools, training and development opportunities that make working at Rollins an enjoyable and rewarding experience.

When you put people first, you also build customer loyalty by ensuring that our teammates have the skills and resources needed to provide exceptional customer service. We are focused on building relationships and trust with our customers by consistently striving to exceed their expectations.

Another key tenet of our culture is promoting a growth mindset throughout our business. Change is constant in today’s environment, so we must remain open and adaptable to new ideas for continuous growth.

As a complement to our growth mindset, our dedication to continuous improvement and operational efficiency is another key tenet of our strategy and culture. We approach our operations from the perspective that everything we do can be improved upon. We are constantly striving to improve our service levels by optimizing our business model and modernizing our business.

Board of Directors Update

We are thankful for the continued commitment of time and expertise of our Board members and remain committed to retaining the best team to guide us in our pursuit of long-term value for our stakeholders. As of the Annual Meeting of Shareholders, we will present a new director nominee, Paul D. Donahue.

Moving Forward

We are optimistic about our future and what we can accomplish together in 2025. On behalf of our Board of Directors and our teammates around the world, we want to thank you for your continued support and investment in Rollins, Inc. We are excited about the future and our ability to deliver long-term shareholder returns.

| | | | | | | | | | | | | | |

| | | | |

| Gary W. Rollins | | John F. Wilson | | Louise S. Sams |

| Executive Chairman Emeritus | | Executive Chairman of the Board | | Lead Independent Director |

PROXY STATEMENT

We are furnishing the proxy materials to shareholders on or about March 13, 2025. The Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be held on April 22, 2025, the Proxy Statement, and the Annual Report are available at http://www.viewproxy.com/ROL/2025.

The following information concerning the Proxy Statement and the matters to be acted upon at the Annual Meeting of Shareholders to be held on April 22, 2025, is submitted by the Company to the shareholders in connection with the solicitation of proxies on behalf of the Company’s Board of Directors.

SOLICITATION OF AND POWER TO REVOKE PROXY

A form of proxy is enclosed. Each proxy submitted will be voted as directed, but if not otherwise specified, proxies solicited by the Board of Directors of the Company will be voted in favor of the candidates for election to the Board of Directors and in favor of ratification of the appointment of our independent registered public accounting firm for the fiscal year ending December 31, 2025. We have designated John F. Wilson, the Company’s Executive Chairman of the Board, and Jerry E. Gahlhoff, Jr., the Company's President and CEO, as proxies for the 2025 Annual Meeting of Shareholders.

A shareholder executing and delivering a proxy has the power to revoke the same and the authority thereby given at any time prior to the exercise of such authority, if they so elect, by contacting either proxy holder, by timely submitting a later dated proxy changing their vote, or by attending the meeting and voting in person. However, a beneficial shareholder who holds their shares in street name must secure a proxy from their broker before they can attend the meeting and vote. All costs of solicitation have been, and will be, borne by the Company.

HOUSEHOLDING AND DELIVERY OF NOTICE OR PROXY MATERIALS

The Company has adopted the process called “householding” for any notice or proxy materials in order to reduce printing costs and postage fees. Householding means that shareholders who share the same last name and address will receive only one copy of the notice or proxy materials, unless we receive contrary instructions from any shareholder at that address.

If you prefer to receive multiple copies of the proxy material at the same address, additional copies will be provided to you promptly upon written or oral request. If you are a shareholder of record, you may contact us by writing to the Company at 2170 Piedmont Rd., NE, Atlanta, GA 30324 or by calling 404-888-2000. Eligible shareholders of record receiving multiple copies of the proxy materials can request householding by contacting the Company in the same manner.

CAPITAL STOCK

The outstanding capital stock of the Company on February 28, 2025 consisted of 485,075,627 shares of Common Stock, par value $1.00 per share. Holders of Common Stock are entitled to one vote (noncumulative) for each share of such stock registered in their respective names at the close of business on February 28, 2025, the record date for determining shareholders entitled to notice of and to vote at the meeting or any adjournment thereof.

MATTERS TO BE VOTED ON AND VOTES NEEDED FOR APPROVAL

A majority of the outstanding shares will constitute a quorum at the Annual Meeting. Abstentions and “broker non-votes” will be counted for purposes of determining the presence or absence of a quorum for the transaction of business. If you are a beneficial owner of shares held in street name and do not provide the organization that holds your shares with specific voting instructions, under the rules of various national and regional securities exchanges, the organization that holds your shares may generally vote on “routine” matters but cannot vote on “non-routine” matters. If the organization that holds your shares does not receive instructions from you on how to vote your shares on a “non-routine” matter, the organization that holds your shares will inform the inspector of election that it does not have the authority to vote on this matter with respect to your shares. The situation in which a broker is able to vote on some matters at a meeting but not others is generally referred to as a “broker non-vote” with respect to those matters on which the broker cannot vote. The proposal to ratify our independent auditors is considered a routine proposal upon which brokers may vote without instruction. Therefore, there likely will be broker non-votes that are not cast with respect to Proposal 1 but are voted by the broker with respect to Proposal 2. In accordance with the General Corporation Law of the state of Delaware, the following votes are needed for approval of each proposal:

| | | | | | | | |

| PROPOSAL | | VOTE NEEDED FOR APPROVAL AND EFFECT OF ABSTENTION AND BROKER NON-VOTES |

| | |

Proposal No. 1: The election of five director nominees to serve as directors of the Company until our 2026 Annual Meeting of Shareholders, or until their successors are duly elected and qualified. | | The election of the director nominees named herein will require the affirmative vote of a plurality of the votes cast by the shares of Company Common Stock entitled to vote in the election, provided that a quorum is present at the Annual Meeting. In the case of a plurality vote requirement (as in the election of directors), where no particular percentage vote is required, the outcome is solely a matter of comparing the number of votes cast for each nominee, with those nominees receiving the most votes being elected, and hence only votes for director nominees (and not abstentions or broker non-votes, as described above) are relevant to the outcome. In this case, the five director nominees receiving the most votes will be elected. |

| | |

Proposal No. 2: To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2025. | | The affirmative vote of a majority of shares present in person or represented by proxy and entitled to vote at the meeting is required to approve the ratification of the appointment of the Company's independent registered public accounting firm for fiscal year 2025. Abstentions will have the effect of a vote against this proposal. Broker non-votes are not relevant to this proposal and will be disregarded. |

| | |

| | |

There are no rights of appraisal or similar dissenter’s rights with respect to any matter to be acted upon pursuant to this Proxy Statement. It is expected that shares held of record and beneficially by officers and directors of the Company, which in the aggregate represent approximately 4.47% percent of the outstanding shares of Common Stock as of the record date, will be voted for the director nominees and for the ratification of the appointment of the Company’s independent registered public accounting firm.

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Board Leadership Structure

The Rollins’ Board of Directors (the “Board”) is led by the Executive Chairman Emeritus and the Executive Chairman of the Board with each of the Board committees being led by a Committee Chairperson. The Company believes it is in its best interest to separate the Board leadership roles from the Chief Executive Officer role, and as of January 2023, Jerry E. Gahlhoff, Jr. began serving as President and Chief Executive Officer of the Company. The separation of the Executive Chairman Emeritus and Executive Chairman of the Board roles from the Chief Executive Officer role allows the Chief Executive Officer to focus his time and energy on operating and managing the Company while leveraging the experience and perspectives of the Executive Chairman Emeritus and the Executive Chairman of the Board.

In order to continue to drive a high performing Board, the Company has continued to elect a Lead Independent Director who is responsible for identifying issues for the Board to consider and properly addressing issues with all directors being heard. Louise S. Sams has served as the Lead Independent Director of the Board following the 2024 Annual Meeting of Shareholders.

The Board believes the current leadership structure consisting of a separate Executive Chairman Emeritus, Executive Chairman of the Board, Chief Executive Officer, and Lead Independent Director represents the appropriate structure for the Company at this time. The specific responsibilities of the Executive Chairman Emeritus, Executive Chairman of the Board, Chief Executive Officer, and Lead Independent Director are outlined in the table below:

| | | | | |

| Executive Chairman Emeritus | •Oversees actions of the Board.

•Advises senior business leaders.

|

| Executive Chairman of the Board | •Sets the agendas for Board meetings in consultation with the CEO, Corporate Secretary, and other members of the Board. •Presides over all Board meetings and the Annual Meeting of Shareholders. •Sees that all orders and resolutions of the Board are carried into effect. |

| |

| Chief Executive Officer | •Sets the operational leadership and strategic direction of the Company. •Sets the day-to-day leadership and performance of the Company. |

| |

| Lead Independent Director | •Serves as the liaison between the Executive Chairman of the Board, the Chief Executive Officer, and the independent directors. •Sets the agendas for, and presides over, the executive sessions of the non-employee and independent directors. •Consults with the Executive Chairman of the Board and the Chief Executive Officer regarding information sent to the Board in connection with Board meetings. •Being available, if requested by the shareholders, when appropriate, for consultation and direct communication. |

| |

Role of the Board

The Company’s business affairs are managed under the direction of the Board, which is currently composed of eleven members, but as of the Annual meeting, the size of the Board will be increased to twelve members. The Board oversees the Company’s Chief Executive Officer and other senior management in the competent and ethical operation of the Company and assures that the long-term interests of the shareholders are being served. In conducting this oversight responsibility, the Board receives regular reports from the Chief Executive Officer and other members of the Company’s senior management team.

The Board’s Role in Oversight of Risk Management

“Risk” is an extremely broad concept that extends to multiple functional areas and crosses multiple disciplines. As such, risk may be addressed by the full Board or by one or more of the Committees of the Board as assigned for risk oversight. The Company maintains an Enterprise Risk Management (“ERM”) program that assists in identifying, monitoring and mitigating the Company’s key enterprise risks. The Company leverages the Committee of Sponsoring Organizations of the Treadway Commission ("COSO") ERM framework designed to help the Company's business leaders understand and prioritize organizational risks and measure how such risks impact the Company’s strategy and performance. The Audit Committee and the Board review the prioritization of the Company’s most important risks and the Company’s key mitigation actions related to those risks.

Senior management is responsible for identifying and managing material risks that the Company faces. Insurable risks and litigation risks are handled primarily by the legal and risk management departments, which provide reports to the Audit Committee. Liquidity risk, credit risk and risks associated with our credit facilities, other debt instruments, and cash management are handled primarily by our finance department, which regularly provides a financial report to the Audit Committee and to the full Board. Operational, business, regulatory and political risks are handled primarily by senior executive management, which regularly provides various operational reports to, among others, the Audit Committee and the full Board. Risks related to the Company’s executive compensation programs and practices, and human capital management strategy and policies, including those related to workplace inclusion and health and safety management, are handled by senior management, which regularly provides reports to the Human Capital Management and Compensation Committee. The Nominating and Corporate Governance Committee receives regular reports from senior management on risks related to the Board and Board committee membership and structure, governance policies and practices, related party transactions, and sustainability initiatives.

The Board’s Role in Oversight of Cybersecurity Risk Management

Cybersecurity has become a particularly acute and chronic area of risk for companies of all sizes and in all industries, including our Company. While management is primarily responsible for our cybersecurity program and managing our cybersecurity risks, including our procedures and day-to-day operations, our Audit Committee supports the Board with oversight responsibility of our cybersecurity risks. The Company has security incident response policies and procedures for identifying, assessing, and managing material risks arising from cybersecurity incidents, including those arising from third-party service providers. The Audit Committee monitors the cybersecurity risk management and cyber control functions, including external security audits, and receives periodic updates from experienced senior management knowledgeable about assessing and managing cyber risks, including, as appropriate, updates on the prevention, detection, mitigation, and remediation of cyber incidents. The Audit Committee also receives regular quarterly reports from our Chief Information Security Officer and reviews our information technology and cybersecurity risk profile. Cybersecurity incidents that significantly impact the confidentiality, integrity, or availability of Company data or the reliability of the Company system or network are reported to the Audit Committee.

Further, our privacy compliance and digital risk management initiatives focus on the threats and risks to enterprise information and the underlying information technology systems processing such information as part of the implementation of business processes. We have also implemented policies and procedures for the assessment, identification, and management of material risks from cybersecurity threats, including internal training, system controls, and monitoring and audit processes to protect the Company from internal and external vulnerabilities and to comply with consumer privacy laws in the areas in which we operate. Further, we limit

retention of certain data, encrypt certain data and otherwise protect information to comply with consumer privacy laws in the areas in which we operate.

The Company also has a cross-functional group of representatives from several departments that comprise the Cybersecurity and Privacy Committee, which meets and discusses information at least quarterly related to cybersecurity and privacy compliance at the Company, including training, policies, and trends. We also use, among other things, commercially available third parties including vendors, cybersecurity protection systems, software, tools and monitoring to provide security for processing, transmission and storage of protected information and data. The systems currently used for transmission and approval of payment card transactions, and the technology utilized in payment cards themselves, all of which can put payment card data at risk, meet standards set by the payment card industry.

The Company has a global cybersecurity training program that requires all employees with access to the Company networks to participate in regular and mandatory training on how to be aware of, and help defend against, cybersecurity risks. Also, the Company regularly tests the efficacy of its training efforts as well as its systems to assess vulnerabilities to cybersecurity risks, including tabletop incident response exercises. We also regularly review our privacy policies to confirm compliance with all applicable data privacy regulations.

The Board’s Role in Oversight of Sustainability Matters

The Nominating and Corporate Governance Committee, pursuant to its charter, has responsibility for oversight of our sustainability initiatives and strategy. We also have a management-level Sustainability Oversight Committee that is comprised of diverse representatives from multiple business functions within the organization and led by our Chief Legal Officer. The Sustainability Oversight Committee is responsible for setting our sustainability strategy and long-term objectives and providing regular reports to the Nominating and Corporate Governance Committee. The Company has also engaged an independent third-party consultant with diverse perspectives to help us better understand our sustainability-related risks and opportunities. Our goal is to drive value for stakeholders and our business. The Company issued its 2023 Sustainability Report in 2024 and plans to issue a similar report later this year.

The Board’s Role in Oversight of Human Capital Management Matters

The Human Capital Management and Compensation Committee, pursuant to its charter, has responsibility for oversight of the Company’s human capital management strategy and policies, including, but not limited to those policies and strategies regarding workplace inclusion and safety. The Human Capital Management and Compensation Committee receives updates from senior management throughout the year on key talent metrics for the overall workforce, including metrics related to workplace inclusion and also receives reports on the Company’s recruiting, training and education, talent acquisition and career development programs.

Director Independence and New York Stock Exchange Requirements

Director Independence

Under our Independence Guidelines, to be considered independent, a director must be determined to have no material relationship with the Company other than as a director. Under the New York Stock Exchange (the “NYSE”) Listed Company Manual, no director qualifies as independent unless the Board affirmatively determines that the director has no material relationship with the Company.

A member of the Audit Committee is considered independent as long as he or she (i) does not accept any consulting, advisory, or compensatory fee from the Company, other than as a director or committee member; (ii) is not an affiliated person of the Company or its subsidiaries; and (iii) otherwise meets the independence requirements of the NYSE and the Company’s Independence Guidelines. The Board has affirmatively determined that all members of the Audit Committee are independent under our Independence Guidelines, the NYSE listing standards, the Securities Exchange Act of 1934, as amended (the "Exchange Act") and SEC rules and regulations promulgated thereunder, the heightened standards required for Audit Committee members, and its charter.

The Board has affirmatively determined that each member of the Nominating and Corporate Governance Committee and the Human Capital Management and Compensation Committee are “independent” under our Independence Guidelines, the NYSE listing standards, the Exchange Act and SEC rules and regulations promulgated thereunder, and the respective charters of such committees. In addition, all members of the Human Capital Management and Compensation Committee meet the heightened independence standards of the NYSE.

Our Independence Guidelines are posted on our website at www.rollins.com under the section titled “Investor Relations – Governance – Governance Documents” and include categorical standards for determining independence in specified situations.

Nonmaterial Relationships

The Board reviewed the following relationships between the independent members of the Board, on the one hand, and the Company, on the other hand:

1.Susan R. Bell and Patrick J. Gunning serve on the Boards of RPC, Inc. and Marine Products Corporation. These companies are controlled by the Significant Shareholder Group as defined below.

2.Donald P. Carson was an executive officer of entities controlled by Gary W. Rollins and the Rollins family at various times from 2003 to 2022. He is currently a director of two such entities, and has served as such since 2003. From 2018 to 2022, he was a paid consultant to one of these entities.

As required by the Independence Guidelines, the Board unanimously concluded that the above-listed relationships would not affect the independent judgment of the independent directors based on their experience, character and independent means, and therefore do not preclude an independence determination. All current and nominated non-management directors have been determined by the Board to be independent.

Director Criteria and Qualifications

Under Delaware law, there are no statutory criteria or qualifications for directors. The Board has prescribed no criteria or qualifications at this time. The Nominating and Corporate Governance Committee does not have a formal policy with regard to the consideration of director candidates. The Nominating and Corporate Governance Committee has discretion in its decision-making. This discretion would extend to how the Nominating and Corporate Governance Committee might consider a director candidate in a particular instance – whether in terms of background, viewpoint, experience, education, demographics, gender, national origin or other considerations. However, our Nominating and Corporate Governance Committee acts under the guidance of our Corporate Governance Guidelines approved by the Board of Directors and posted on our website at www.rollins.com under the section titled “Investor Relations – Governance – Governance Documents.”

Director Selection and Screening Process

The Board believes that it should preserve maximum flexibility in order to select directors with sound judgment and other desirable qualities. Under the Company’s Corporate Governance Guidelines, the Board is responsible for selecting nominees for election to the Board. The Board has delegated the screening process of director nominees for nomination to the Board and service on the committees of the Board to the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee is responsible for determining the appropriate skills and characteristics required of Board members in the context of the current make-up of the Board. This determination takes into account all factors which the Nominating and Corporate Governance Committee considers appropriate, such as independence, experience, strength of character, mature judgment, technical skills, age, and the extent to which the individual would fill a present need on the Board.

Director Onboarding and Continuing Education

New directors are required to participate in an orientation program that includes background materials and meetings with senior management. All directors are encouraged to stay abreast of developing trends applicable

to the Company’s business and specific to service as a director. Directors may be expected to participate in continuing educational programs relating to our Company’s business, corporate governance or other issues pertaining to their directorships in order to maintain the necessary level of expertise to perform their responsibilities as directors. The Company has a Director Continuing Education Policy and also provides all directors with membership in the National Association of Corporate Directors.

Director Candidates Recommended by Shareholders

Our Amended and Restated By-Laws provide that any shareholder entitled to vote for the election of directors may make nominations for the election of directors. Nominations must comply with an advance notice procedure which generally requires, with respect to nominations of directors for election at an annual meeting, that written notice be addressed to:

Corporate Secretary

Rollins Inc.

2170 Piedmont Road, NE

Atlanta, Georgia 30324

Notices with respect to nominations of directors for election at an annual meeting must be received not less than ninety (90) days nor more than one hundred and thirty (130) days prior to the anniversary of the prior year’s annual meeting and shall set forth, among other requirements set forth in detail in the Company’s Amended and Restated By-Laws, the:

•name of the nominee;

•age of the nominee;

•business address of the nominee;

•residence address of the nominee (if known);

•the principal occupation or employment of the nominee for the past five years;

•the nominee’s qualifications;

•the class or series and number of shares of capital stock of the Company which are owned beneficially or of record by the nominee; and

•any other information relating to the nominee that would be required to be disclosed in a proxy statement or other filings.

Other requirements related to the notice are contained in our Amended and Restated By-Laws, and shareholders are advised to carefully review those requirements to ensure that nominations comply with the Amended and Restated By-Laws. The Nominating and Corporate Governance Committee will consider nominations from shareholders who satisfy the above notice requirements. In addition, a shareholder intending to solicit proxies in support of non-Company director nominees must also comply with SEC Rule 14a-19(b).

Director Communications

The Company also has a process for interested parties, including shareholders, to send communications to the Board of Directors, Lead Independent Director, any of the Board committees or the non-management or independent directors as a group. Such communications should be addressed as follows:

Lead Independent Director

Rollins, Inc.

c/o Corporate Secretary

2170 Piedmont Road, NE

Atlanta, Georgia 30324

The above instructions for communications with the directors are also posted on our website at www.rollins.com under the “Investor Relations – Governance – Overview” section. All communications received from interested parties are forwarded to the Board. Any communication addressed solely to the Lead Independent Director or the non-management or independent directors will be forwarded directly to the appropriate addressee(s).

Corporate Governance Guidelines

The Board has adopted Corporate Governance Guidelines to formalize and promote better understanding of our policies and procedures. The Board reviews these guidelines annually. A copy of our current Corporate Governance Guidelines may be found on our website at www.rollins.com under the section titled “Investor Relations – Governance – Governance Documents.” Our Corporate Governance Guidelines require that our non-management directors meet in at least two regularly scheduled sessions per year without management. In accordance with NYSE rules, the independent directors also meet separately at least once per year.

Code of Business Conduct and Ethics

The Company has adopted a Code of Business Conduct and Ethics applicable to all directors, officers and employees generally, as well as a Code of Business Conduct and Ethics for Directors and Executive Officers and Related Party Transactions applicable to the directors and the principal executive officer, principal financial officer, and the principal accounting officer or controller or person performing similar functions for the Company. Both codes of business conduct are available on our website at www.rollins.com under the section titled “Investor Relations – Governance – Governance Documents.”

Committees of the Board of Directors

Our Board has an Audit Committee, a Human Capital Management and Compensation Committee, and a Nominating and Corporate Governance Committee, each of which has the composition and the responsibilities described below. Members will serve on these committees until their resignation or until as otherwise determined by our Board. Our Board committees regularly make recommendations and report on their activities to the entire Board. Each committee may obtain advice from internal or external financial, legal, accounting, or other advisors at their discretion. In addition, we have, from time to time, formed a special committee for the purpose of evaluating and approving certain transactions in which other directors of the Company have an interest.

The Board has adopted written charters for the Audit Committee, Human Capital Management and Compensation Committee, and the Nominating and Corporate Governance Committee which are available on our website at www.rollins.com under the section titled “Investor Relations – Governance – Governance Documents.”

| | | | | |

| Audit Committee |

|

|

Current Members: Susan R. Bell (Chair) Donald P. Carson Patrick J. Gunning Gregory B. Morrison | Key Responsibilities: •Appoints and meets independently with the Company’s independent registered public accounting firm to audit the Company’s financial statements. •Assesses the independence and oversees the performance of the Company’s independent registered public accounting firm. •Pre-approves all audit and all permissible non-audit services to be performed by the Company’s independent registered public accounting firm. •Discusses with the Company’s independent registered public accounting firm all matters required to be discussed under the standards of the Public Company Accounting Oversight Board and the SEC or other regulations. •Reviews the Company’s financial statements and critical accounting policies and estimates. •Reviews the adequacy and effectiveness of our internal controls and disclosure controls and procedures. •Assesses the performance of the Company’s internal audit department. •Reviews the Company’s insider trading and anti-corruption policies. •Oversees procedures for the receipt, retention, and treatment of complaints received by the Company regarding accounting, internal accounting controls, or auditing matters, and the confidential, anonymous submission by employees of the Company of concerns regarding questionable accounting or auditing matters. •Reviews and discusses with management the Company’s internal control procedures associated with the Company’s sustainability reporting. •Oversees the Company’s ERM process and cybersecurity risk management, including reviewing reports and updates received by management on a quarterly and as-needed basis. |

| |

The Audit Committee consists of Ms. Bell, and Messrs. Carson, Gunning and Morrison. The Board has concluded that (i) Mr. Gunning and Ms. Bell are qualified as “Audit Committee Financial Experts” within the meaning of the rules of the SEC and that they have accounting and related financial management expertise within the meaning of the NYSE listing standards; (ii) all members of the Audit Committee are “Financially Literate” as required under the rules of the NYSE; and (iii) Ms. Bell’s simultaneous service on the audit committees of more than three public companies does not impair her ability to effectively serve on the Company’s Audit Committee.

| | | | | |

| Human Capital Management and Compensation Committee |

| |

Current Members: Gregory B. Morrison (Chair) Dale E. Jones Louise S. Sams | Key Responsibilities: •Reviews the Company’s executive compensation philosophy and strategy. •Reviews and approves the corporate goals and objectives relevant to the compensation of the Company’s CEO and executive officers, as well as variable compensation. •Evaluates the performance of the Company’s CEO and executive officers. •Reviews the compensation of the Company’s non-employee directors for service on the Board and its committees and recommends changes to the Company’s director compensation program as appropriate. •Determines the stock ownership guidelines for the Company’s CEO, executive officers, and other key executives and monitors compliance with such guidelines. •Approves grants of awards under the Company’s equity incentive plans and adopts or modifies policies that govern such plans. The Committee may from time to time, in its discretion, delegate its authority under such plans to another committee of the Board or to one or more directors, which it has done for non-NEO stock grants. •Retains an independent Compensation Consultant and oversees the qualifications, performance, and independence of the Compensation Consultant. •Oversees the Company's benefit plans and safety programs. •Receives updates from senior management throughout the year on key talent metrics for the overall workforce, including metrics related to workplace inclusion and also receives reports on the Company’s recruiting, training and education, talent acquisition and career development programs. •Oversees the Company's succession plan for its management. •Oversees the development and management of the Company’s human capital management strategy and policies, including but not limited to those policies and strategies regarding workplace inclusion. |

| |

Human Capital Management and Compensation Committee Interlocks and Insider Participation

The Human Capital Management and Compensation Committee consists of Messrs. Jones and Morrison and Ms. Sams. None of these individuals are or were a current or former officer or employee of the Company or any of its subsidiaries. In addition, none of these individuals had a relationship with the Company since the beginning of fiscal year 2024 that required disclosure by the Company under the SEC rules on transactions with related persons. No executive officer of the Company has served as a director or member of the compensation committee or other board committee of another entity that had an executive officer who served on the Company’s Board or Human Capital Management and Compensation Committee.

| | | | | |

| Nominating and Corporate Governance Committee |

| |

Current Members: Louise S. Sams (Chair) Donald P. Carson P. Russell Hardin

| Key Responsibilities: •Determines the appropriate qualifications required of the members of the Board. •Recommends Board committee chairs and assignments. •Recommends to our Board nominees for director and considers any nominations properly made by a shareholder. •Makes recommendations to our Board regarding the agenda for our annual shareholders’ meetings and with respect to appropriate action to be taken in response to any shareholder proposals. •Conducts periodic reviews of the composition and size of the Board and its committees, as well as the frequency and procedures of Board meetings. •Oversees compliance with key corporate governance policies, including the company’s Corporate Governance Guidelines and Independence Guidelines. •Reviews and approves related party transactions. •Reviews and monitors the Company’s sustainability practices, policies, programs and public disclosures. •Reviews and assesses the adequacy of the Company’s Code of Business Conduct and Ethics. |

| |

Board and Board Committee Meetings

Under our Corporate Governance Guidelines, directors are expected to attend all regular and special meetings of the Board and Board committees upon which they serve. Directors are also expected to attend the Annual Shareholders Meeting. Each incumbent director attended at least 75 percent of the aggregate of the Board meetings held in 2024 and the meetings of the committees on which they served during 2024, and all members of the Board at that time attended last year’s Annual Shareholders Meeting.

The following table shows the current membership (“M”), chairperson (“C”), and chairperson emeritus ("CE") of the Board and each of the Board committees, the number of Board and Board committee meetings held in 2024 and actions taken by unanimous written consent in lieu of meetings:

| | | | | | | | | | | | | | |

| Name | Board of

Directors | Audit Committee | Human Capital

Management and

Compensation

Committee | Nominating and

Corporate

Governance

Committee |

| Gary W. Rollins | CE | | | |

| John F. Wilson | C | | | |

| Susan R. Bell | M | C | | |

| Donald P. Carson | M | M | | M |

| Jerry E. Gahlhoff, Jr. | M | | | |

| Patrick J. Gunning | M | M | | |

| P. Russell Hardin | M | | | M |

| Dale E. Jones | M | | M | |

| Gregory B. Morrison | M | M | C | |

| Pamela R. Rollins | M | | | |

| Louise S. Sams | M | | M | C |

| # of Meetings Held | 4 | 7 | 5 | 6 |

| # of Actions Taken by Written Consent | 1 | — | 1 | 1 |

Executive Sessions

Our Corporate Governance Guidelines require that the non-management directors meet in at least two regularly scheduled executive sessions per year without management. Our non-management directors meet at regularly scheduled executive sessions without management. In accordance with the NYSE corporate governance listing standards, Ms. Sams, as the Lead Independent Director, presides over the executive sessions. All current and nominated non-management directors have been determined by the Board to be independent, other than Ms. Rollins. The independent directors meet separately at least once annually, and Ms. Sams, as the Lead Independent Director, presides over these executive sessions.

DIRECTOR COMPENSATION

Overview of the Non-Employee Director Compensation Program

Members of the Board who are not employees (“Non-Employee Directors”) receive compensation for their service. The compensation program for our Non-Employee Directors is intended to provide a total compensation package that enables us to attract and retain qualified and experienced individuals to serve as directors and to align our directors’ interests with those of our shareholders. All Non-Employee Directors are also entitled to reimbursement of expenses for all services as a director, including reasonable travel expenses incurred in connection with required in-person attendance at board and committee meetings, committee participation, or special assignments.

The Human Capital Management and Compensation Committee annually reviews each element of our Non-Employee Director compensation program and the total amount paid thereunder and makes recommendations to the Board. In addition, at the Human Capital Management and Compensation Committee’s direction, Mercer (US) LLC (“Mercer”), the Committee’s independent executive compensation advisory firm, provides a competitive analysis of director compensation levels, practices, and design features as compared to the general market as well as our compensation peer group.

2024 Annual Non-Employee Director Compensation Program

Under the Director Compensation Program in effect in 2024, our Non-Employee Directors received an annual cash retainer in the amount of $100,000 and an annual equity award consisting of restricted stock with a fair value of $100,000, which stock is vested when issued but must be held for a period of one (1) year from the date of such grant and until such director is in compliance with their ownership requirement under the Non-Employee Director Stock Ownership Guidelines. Committee Chairs also received additional annual cash retainers. All cash retainers are payable in equal quarterly installments in arrears, and the equity awards are paid following the Annual Meeting. For each Non-Employee Director who is elected or appointed for the first time, the first quarterly installment of the annual cash retainers will be paid for the first quarter that ends on or after the date of his or her initial election or appointment, prorated based on service during the quarter.

The following table sets forth the 2024 Non-Employee Director Compensation Program:

| | | | | | | | | | | |

| Board/Committee | Annual

Cash Retainer

($) | Annual Equity

Award

($) | Annual Chair

Cash Retainer

($) |

| Board of Directors | 100,000 | 100,000 | — |

| Audit Committee Chair | — | — | 30,000 |

| Human Capital Management and Compensation Committee Chair | — | — | 10,000 |

| Nominating and Corporate Governance Committee Chair | — | — | 6,000 |

2024 Director Compensation Table

The following table sets forth the compensation paid to our Non-Employee Directors for services rendered as a director for the year ended December 31, 2024. Three of our directors, Messrs. Gary W. Rollins, John F. Wilson and Jerry E. Gahlhoff, Jr. are employees of the Company, and their employee compensation information is set forth in the “Summary Compensation Table” on page 45 under the “Executive Compensation” section of this Proxy Statement. Directors that are our employees do not receive any additional compensation for services rendered as a director. | | | | | | | | | | | |

| Name | Fees Earned or

Paid in Cash

($) | Annual Restricted Stock Award(1) ($) | Total

($) |

| Susan R. Bell | 130,000 | 100,000 | 230,000 |

| Donald P. Carson | 100,000 | 100,000 | 200,000 |

| Patrick J. Gunning | 100,000 | 100,000 | 200,000 |

| P. Russell Hardin | 100,000 | 100,000 | 200,000 |

| Dale E. Jones | 75,000 | 100,000 | 175,000 |

| Gregory B. Morrison | 107,500 | 100,000 | 207,500 |

| Pamela R. Rollins | 100,000 | 100,000 | 200,000 |

| Louise S. Sams | 104,500 | 100,000 | 204,500 |

(1)Amounts in this column represent the grant date fair value of the equity awards granted to the non-employee directors, calculated in accordance with FASB ASC Topic 718. The amounts reported in this column represent the fair value of the total number of shares issued to each director rounded up to the nearest whole dollar. These equity grants must be held for a period of one (1) year from the date of the grant and until stock ownership guidelines are satisfied.

The following is our anticipated non-employee director compensation for 2025.

| | | | | |

| 2025 |

| Annual Cash Retainer | $100,000 |

| Annual Equity Award | $150,000 |

| Lead Director Annual Cash Retainer | $30,000 |

| Audit Chair Annual Cash Retainer | $30,000 |

| Human Capital Management and Compensation Chair Annual Cash Retainer | $15,000 |

| Nominating and Corporate Governance Chair Annual Cash Retainer | $12,000 |

Non-Employee Director Stock Ownership Guidelines

Under Stock Ownership Guidelines (“Guidelines”), Non-Employee Directors are required to beneficially own, within five years from the date they become subject to the Guidelines, common stock of the Company equal in value at least three times the non-employee director annual cash retainer determined as of the last day of the prior fiscal year with the average closing price of the prior 90 days. Non-Employee Directors are prohibited from selling Company stock granted to such director by the Company for a period of one (1) year from the date of such grant and until such director is in compliance with their ownership requirement under the Guidelines.

INFORMATION REGARDING DIRECTOR NOMINEES AND CONTINUING DIRECTORS

The following table sets forth the names, ages as of February 28, 2025, and certain other information for each of the nominees for election as a director at the Annual Meeting and for each of the continuing members of our Board following the Annual Meeting. Each of the nominees other than Mr. Donahue is currently a director of the Company. Full biographical information follows the table.

| | | | | | | | | | | | | | |

| Name | Age | Independent | Director Since | Current Term

Expires |

| DIRECTOR NOMINEES: | | | | |

| Susan R. Bell | 62 | Yes | 2021 | 2025 |

| Donald P. Carson | 75 | Yes | 2021 | 2025 |

| Paul D. Donahue | 68 | Yes | — | — |

| Louise S. Sams | 67 | Yes | 2022 | 2025 |

| John F. Wilson | 67 | No | 2013 | 2025 |

| CONTINUING DIRECTORS: | | | | |

| Jerry E. Gahlhoff, Jr. | 52 | No | 2021 | 2026 |

| Patrick J. Gunning | 65 | Yes | 2021 | 2026 |

| P. Russell Hardin | 67 | Yes | 2023 | 2027 |

| Dale E. Jones | 65 | Yes | 2024 | 2027 |

| Gregory B. Morrison | 65 | Yes | 2021 | 2026 |

| Gary W. Rollins | 80 | No | 1981 | 2027 |

| Pamela R. Rollins | 68 | No | 2015 | 2027 |

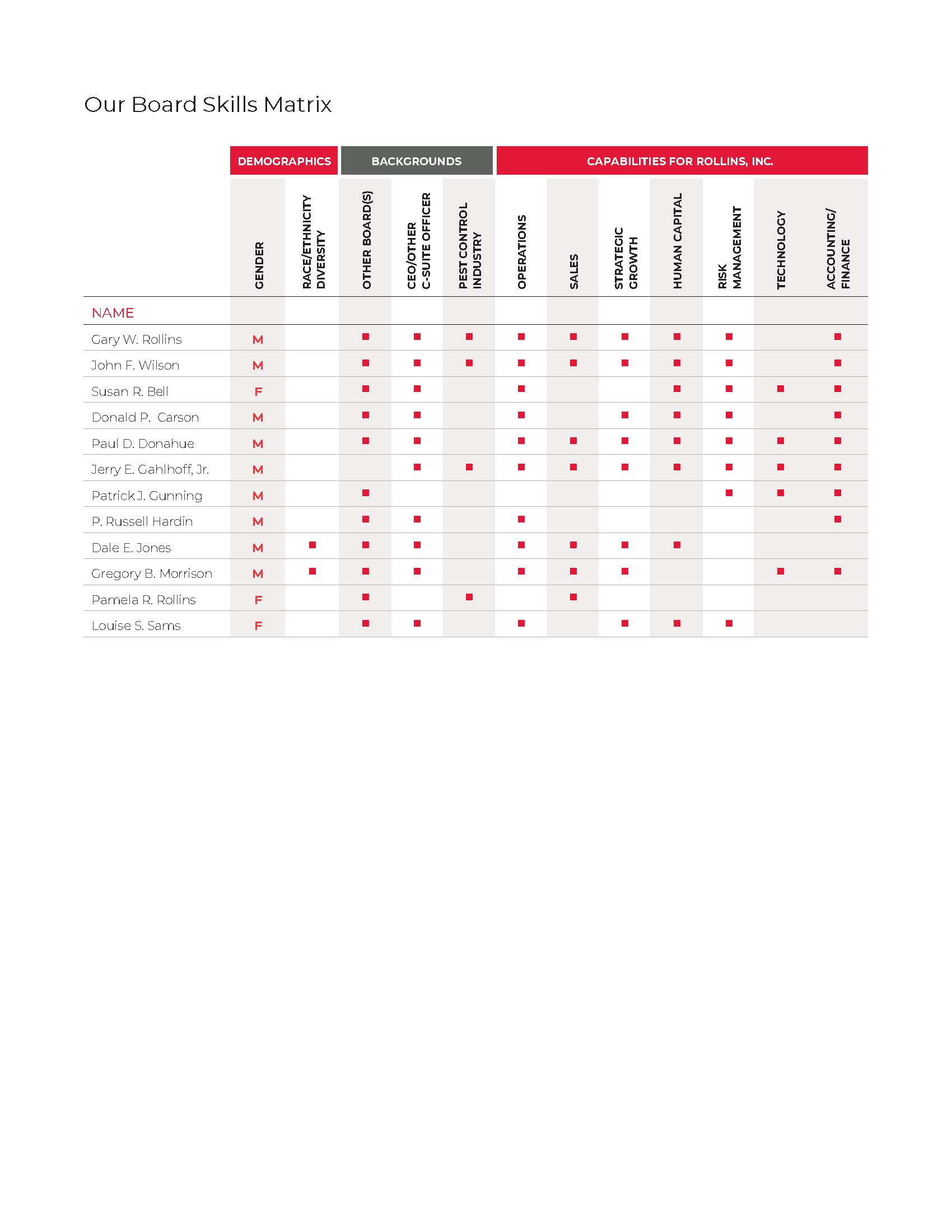

Key Attributes, Experience, and Skills of Director Nominees and Continuing Directors

Director Nominees

| | | | | |

| Susan R. Bell

Retired Partner, Ernst & Young LLP

Chairperson of the Audit Committee |

Susan R. Bell has served as a Director of Rollins, Inc. since January 2021. Ms. Bell retired as partner from Ernst & Young LLP in 2020 after a 36-year career in public accounting. At Ernst & Young LLP, Ms. Bell served as both an audit and advisory partner, led the Southeast Risk Advisory practice and served as the Atlanta Office Managing Partner. Prior to working at Ernst & Young LLP, Ms. Bell started her career at Arthur Andersen LLP in 1984 where she served as an audit partner from 1996 to 2002. Ms. Bell has extensive experience with accounting and auditing, internal controls over financial reporting, enterprise risk management, financial IT systems implementations and testing, mergers and acquisitions, dispositions, initial public debt and equity offerings and other securities offerings.

Ms. Bell currently serves as a member of the Board of Directors of RPC, Inc., Marine Products Corporation and First Advantage Corporation, roles she has held since 2021, and also serves on the audit committees of those corporations and on the compensation committee of First Advantage Corporation. She also is audit committee chair for First Advantage Corporation. Ms. Bell graduated summa cum laude from Mississippi State University with a Bachelor of Professional Accountancy and is a Certified Public Accountant in Georgia and Tennessee.

|

| Donald P. Carson Co-founder and Managing Director, The Ansley Capital Group, LLC and Ansley Securities LLC Member of the Nominating and Corporate Governance Committee Member of the Audit Committee |

| | | | | |

Donald P. Carson has served as a Director of Rollins, Inc. since 2021. Mr. Carson brings extensive financial and strategic experience to our Board of Directors. Mr. Carson is the founder of Don Carson Associates, LLC, and co-founder of The Ansley Capital Group, LLC, Ansley Securities LLC, and Cardez Hospitality Group, LLC. Mr. Carson previously served as President of RFA Management Company, LLC, an Atlanta-based family office, from 2019 to 2022, and previously from 2003 to 2013. Mr. Carson worked for many years in the investment and commercial banking industry, primarily for Wachovia Bank, N.A. from 1977 to 1997. During this time, he was head of the international banking and investment banking businesses. After leaving Wachovia, Mr. Carson became a partner of Paradigm Capital where he was employed from 1998 to 1999 and later co-founded The Ansley Capital Group, LLC and Ansley Securities, LLC, where he is a Managing Director. Mr. Carson currently serves as a director of LOR, Inc., a role he has held since 2003. He also currently serves as a trustee of Beloit College and serves on the board of Black Mountain College Museum + Arts Center. Mr. Carson is also a trustee of The Gary W. Rollins Foundation.

Mr. Carson appears on numerous recordings for Telarc and Deutsche Grammophon with the Atlanta Symphony Orchestra Chorus. Four of these recordings have earned Grammys. He is a voting member of The Recording Academy. Mr. Carson received a Bachelor of Arts degree in Music Composition from Beloit College, and a Master of Business Administration in Finance from the University of Chicago. He also is a graduate of the Thunderbird School of Global Management of Arizona State University.

|

| Paul D. Donahue Non-Executive Chairman, Genuine Parts Company |

Paul D. Donahue is a new nominee for Director of Rollins, Inc. Mr. Donahue serves as Non-Executive Chairman of Genuine Parts Company, a Fortune 200 global distributor of automotive and industrial parts. He previously served as Chief Executive Officer from 2016 to 2024 and Chairman from 2019 to 2024. He has held several key management positions in his 21+ years with GPC, including executive leadership roles at S.P. Richards Company, GPC’s business products group, and the U.S. Automotive Parts Group.

Prior to joining GPC, Mr. Donahue served in various roles at Newell Office Products. He was President of Sanford North America from 1998 – 2002, Vice President in 1997 and Vice President of Sales from 1991 – 1996. Mr. Donahue began his career with the Newell Companies in 1978 and held numerous sales and management roles during his tenure.

He is an active supporter of The United Way, Boys and Girls Clubs of America, the Shepherd Center and the City of Refuge. He is a member of the Carlyle Fraser Heart Center Advisory Committee and the Woodruff Arts Center Board of Trustees. Paul also served as 2023 chair of the Metro Atlanta Chamber and on Truist Bank’s Board of Directors from 2019 to 2023. |

| Louise S. Sams

Retired Vice President and General Counsel, Turner Broadcasting System, Inc.

Lead Independent Director of the Board of Directors

Chairperson of the Nominating and Corporate Governance Committee

Member of the Human Capital Management and Compensation Committee |

| | | | | |

Louise S. Sams has served as a Director of Rollins since 2022. She previously served as the Executive Vice President and General Counsel of Turner Broadcasting System, Inc. (“Turner”), a television and media conglomerate, from 2000 until September 2019. As General Counsel, Ms. Sams oversaw legal work relating to all of the business activities of Turner and its subsidiaries worldwide. Ms. Sams managed a global legal department overseeing licensing, clearance and production of content for the Turner television networks and related media services, the sale and distribution of those networks, protection of intellectual property, employment matters, litigation, and transactional work, such as acquisitions and joint ventures.

Ms. Sams also served as President, Turner Broadcasting System International, Inc. from September 2003 until May 2012. Ms. Sams has extensive experience related to technology, information security, use of data and consumer privacy, as well as enterprise-wide risk management. In Ms. Sams’ role as President, Turner Broadcasting System International, Inc., Ms. Sams was responsible for production, distribution and ad sales relating to all kids and entertainment television networks and media services offered by Turner outside of the U.S. and Canada, distribution and commercial operations of CNN’s international services, and Turner’s international joint ventures. Prior to joining Turner in 1993 as a corporate attorney, Ms. Sams was an associate at White & Case, specializing in mergers and acquisitions.

Ms. Sams currently serves as a member of the Board of Directors of CoStar Group and Loop Industries, positions she has held since December 2019 and April 2021, respectively. Ms. Sams serves on the Audit Committee of Costar and the Audit and Compensation and Governance Committees of Loop Industries. Ms. Sams currently serves on the following non-profit boards: Princeton University, where she is Chair of the Board of Trustees and Chair of the Executive Committee, Board Development Committee and Compensation Committee; High Museum of Art in Atlanta; Woodruff Arts Center and The Westminster Schools. Ms. Sams received a J.D. from the University of Virginia School of Law, and a B.A. from Princeton University, where she graduated magna cum laude. |

| | | | | |

| John F. Wilson

Executive Chairman of the Board |

John F. Wilson has served as a Director of Rollins, Inc. since 2013, and as Executive Chairman of the Board beginning January 1, 2025. He previously served as the Vice Chairman of the Company since 2020. Mr. Wilson has extensive knowledge of the Company’s business and industry having served in various roles of increasing responsibility at the Company for over 30 years. He previously served as Vice President of the Company from 2011 to 2013, President and Chief Operating Officer of the Company from 2013 to 2020, and as President of Orkin, LLC from 2009 to 2013.

In addition to his role at Rollins, Mr. Wilson has been a member of the Board of Directors for RPC, Inc. and Marine Products Corporation since April 2022. He also served as Vice Chairman of The Professional Pest Management Association and as a member of The Carter Center Board of Councilors, positions he has held since 2011 and 2015, respectively.

|

| Continuing Directors |

| Jerry E. Gahlhoff, Jr.

Chief Executive Officer and President |

Jerry Gahlhoff Jr. has served as a Director of Rollins, Inc. since 2021. In 2022, Mr. Gahlhoff was elected by the Board of Directors to serve as Chief Executive Officer of the Company, effective January 1, 2023, in addition to his role as President, a role he has held since 2020. Mr. Gahlhoff also served as Chief Operating Officer of the Company from 2020 to 2022. Prior to that, Mr. Gahlhoff served as President of the Company’s Specialty Brands and Vice President of Human Resources from 2016 to 2020, and as a Division President from 2011 to 2016. Mr. Gahlhoff joined the Company as part of the HomeTeam acquisition in 2008.

Mr. Gahlhoff has been instrumental in driving the Company’s growth initiatives and has extensive knowledge of the Company’s business and industry having served in various roles of increasing responsibility at the Company for over 25 years.

Mr. Gahlhoff has served as a board member of Zoo Atlanta since 2023 and was appointed to the Culligan International Board of Directors in 2025. He also serves as Treasurer of the Pest Management Board of Trustees and as Vice Chairman of The Professional Pet Management Association, roles he has held since 2022 and 2024, respectively. Mr. Gahlhoff earned a Master of Science in Entomology from the University of Florida.

|

| | | | | |

| Patrick J. Gunning

Retired Chief Financial Officer, The Woodruff Arts Center

Retired Partner, Ernst & Young LLP

Member of the Audit Committee |

Patrick J. Gunning has served as a Director of Rollins, Inc. since January 2021. Mr. Gunning brings extensive risk oversight and financial and strategic experience to our Board of Directors. Mr. Gunning previously served as the Chief Financial Officer of the Robert W. Woodruff Arts Center, Inc., a non-profit organization, from November 2020 to June 2022. In June 2020, Mr. Gunning retired as a partner from Ernst & Young LLP, a role he held since May 2002, after a 39 year career in public accounting. Mr. Gunning held multiple leadership roles at Ernst & Young LLP including Southeast Region Leader of the Financial Accounting Advisory Services practice, Southeast Area Industry Leader of the Retail and Consumer Products practice, and lead audit partner for numerous publicly traded and privately owned companies.

Prior to joining Ernst & Young LLP, Mr. Gunning worked at Arthur Andersen LLP from 1981 to 2002, where he served as a partner, lead audit partner for numerous publicly traded and privately owned companies, and Assurance Division Leader. Mr. Gunning currently serves on the Board of Directors of RPC, Inc. and Marine Products Corporation, roles he has held since 2021. Mr. Gunning received a Bachelor of Business Administration in Accountancy from the University of Notre Dame.

|

| P. Russell Hardin

Retired President, Robert W. Woodruff Foundation, Inc.

Member of the Nominating and Corporate Governance Committee |

P. Russell Hardin has served as a Director of Rollins, Inc. since April 2023. He served as the President of the Robert W. Woodruff Foundation, Joseph B. Whitehead Foundation, Lettie Pate Evans Foundation and Lettie Pate Whitehead Foundation from 2006 until 2025. Mr. Hardin joined the Foundations’ staff in 1988 and became President in 2006. Previously, Mr. Hardin practiced law with the Atlanta firm of King & Spalding from 1982 to 1987. Mr. Hardin serves as lead independent trustee of Northwestern Mutual Life Insurance Company, where he has served as a trustee since 2011, and currently serves as a director of Genuine Parts Company, a role he has held since 2017. He also serves as a director on the Truist Atlanta Advisory Council and The Commerce Club in Atlanta.

Mr. Hardin offers the Board extensive experience in the areas of finance, management, strategic planning, philanthropy, governance, and law. Mr. Hardin received his Bachelor of Arts degree with high distinction from the University of Virginia in 1979, and a Juris Doctorate degree with honors from Duke University School of Law in 1982.

|

| Dale E. Jones

Chief Executive Officer, Magna Vista Partners

Member of the Human Capital Management and Compensation Committee |

| | | | | |

Dale E. Jones has served as Chief Executive Officer of Magna Vista Partners, a global leadership consulting firm, since September 2022. He has also served as a senior advisor to Diversified Search Group, an executive search firm, since January 2022, where he previously served as President and Chief Executive Officer from January 2015 to December 2021 and as President from October 2013 to January 2015. Prior to that, Mr. Jones served as Vice Chairman and partner of the CEO and Board Practice in the Americas at Heidrick & Struggles from 2009 to 2013. From 2007 to 2009, he served as Chief Executive Officer of PlayPumps International and as Executive Vice President of Revolution LLC, a venture capital firm. Mr. Jones held several executive leadership positions at Heidrick & Struggles from 1999 to 2007.

Mr. Jones has served on the boards of directors of Chick-fil-A, Inc., a fast-food restaurant chain, since January 2021, and of Outset Medical, Inc., a medical technology company, since 2022. Previously, he served on the boards of directors of Northwestern Mutual, a financial services company, from 2007 to May 2022, of Kohl’s Corporation, an omnichannel retailer, from 2008 to 2016, and of Hughes Supply from 2003 to 2006 (prior to its acquisition by The Home Depot). He also has served on the Advisory Board of Crider Foods since 2023. Mr. Jones has extensive knowledge and experience with business strategy, board issues and corporate governance, and human capital. Mr. Jones holds a B.A. from Morehouse College.

|

| Gregory B. Morrison

Retired Senior Vice President and Corporate Chief Information Officer, Cox Enterprises, Inc.

Member of the Audit Committee

Chairperson of the Human Capital Management and Compensation Committee |

Gregory B. Morrison has served as a Director of Rollins, Inc. since 2021. He is the former Senior Vice President and Corporate Chief Information Officer for Cox Enterprises, Inc., a role he held from February 2002 until his retirement in January 2020. During his 18 years at Cox, Mr. Morrison was responsible for providing corporate strategic planning, policy development and management of all information technology systems and overseeing cybersecurity matters. Prior to his role at Cox, Mr. Morrison served as Executive Vice President and Chief Operating Officer of RealEstate.com in 2000 and held various information and technology leadership roles at Prudential Financial from 1989 to 2002.

Mr. Morrison has extensive knowledge and expertise with cybersecurity, large-scale business transformations and the development of key technological advances that help improve manual business processes. Mr. Morrison was named among the industry’s top performing Chief Information Officers who have shown unparalleled leadership to drive innovation and transformation in businesses. Mr. Morrison has served as Chairman of the Clark Atlanta University Board of Trustees since 2004. Mr. Morrison was a commissioned officer in the US Army from 1982 to 1989. Mr. Morrison received a Bachelor of Science in Mathematics and Physics from South Carolina State University, and a Master of Science in Industrial Engineering from Northwestern University. |

| Gary W. Rollins Executive Chairman Emeritus

|

| | | | | |

Gary W. Rollins has served as a Director of Rollins, Inc. since 1981 and began serving as the Executive Chairman Emeritus of the Board in January 2025. Previously, he served as Chairman of the Company beginning in 2020. Mr. Rollins also held the role of Chief Executive Officer of Rollins, Inc. from 2001 to 2022.

Mr. Rollins has extensive knowledge of the Company’s business and industry having started out as a technician with the Company and serving in various roles of increasing responsibility for over 56 years, all the way up to CEO. Under Mr. Rollins’ leadership as CEO over the past 20 years, the Company has experienced dramatic expansion that has significantly increased its value and global footprint. In 2020, Mr. Rollins was named one of Atlanta’s Most Admired CEOs by the Atlanta Business Chronicle. In 2021, he received the Crown Leadership Lifetime Achievement Award from Pest Control Technology and Syngenta for his decades of success supporting the industry. This award is determined by previous Crown Leadership Award recipients and is one of the most prestigious industry awards that is only given to those who have dedicated more than 25 years to advancing pest control.

Mr. Rollins has played an active role in upholding his strong family legacy of philanthropy. Under his guidance and passion for giving, Rollins’ employees have supported the United Way of Greater Atlanta since 1985. Over the course of our 41-year history with United Way, Rollins has raised over $21 million through employee donations and company matches that went to local communities in need. Mr. Rollins has been instrumental in instilling a culture of serving our community and has established Rollins as a community leader.

Mr. Rollins is currently a Director of Marine Products Corporation and RPC, Inc., roles he has held since 2001 and 1984, respectively. He previously served as the Non-Executive Chairman of both companies from 2020 to 2022. Mr. Rollins also previously served as a Director of Genuine Parts Company from 2005 to 2017. Mr. Rollins received a BS in Business Administration from the University of Tennessee.

|

| Pamela R. Rollins Community Leader |